Navigating the Knowledge Continuum From Known to Unknowable

Navigating the Prime Number Maze and Decision Making Under Uncertainty

Imprisoned within the labyrinth at Knossos, on the storied island of Crete, there lay a creature born of ancient sins and divine anger—a Minotaur, part man, part bull, condemned to a life of endless isolation and insatiable hunger. The tale is so ancient that Homer references it in the Iliad, a text composed before 700 BCE.

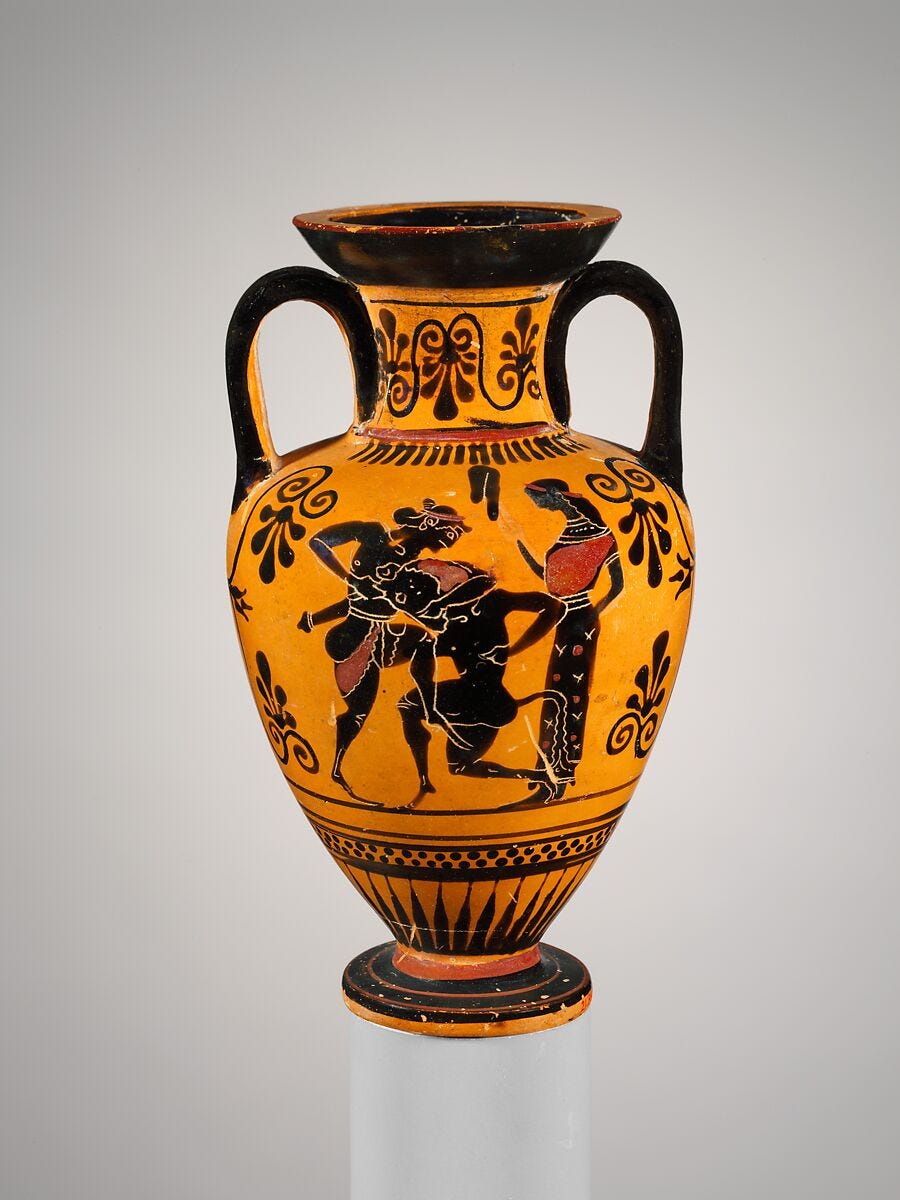

Greek vases frequently portrayed Theseus, the Athenian prince, navigating the maze with a ball of thread in order to retrace his steps. Theseus confronted and killed the Minotaur, an act of bravery immortalized in the art of a civilization.

Greek vase, circa 500 BCE

Unearthed from the soil of Knossos, the coins bore the engravings of the labyrinth.

Hellenistic coin from Knossos, 300-200 BCE

The human fascination with mazes has continued through the centuries, exemplified by the Labyrinth of Versailles, the Chartres Cathedral Labyrinth, the Turf Maze at Saffron Walden, the Hedge Maze at Villa Pisani, and the Gardens of Bomarzo, to name a few.

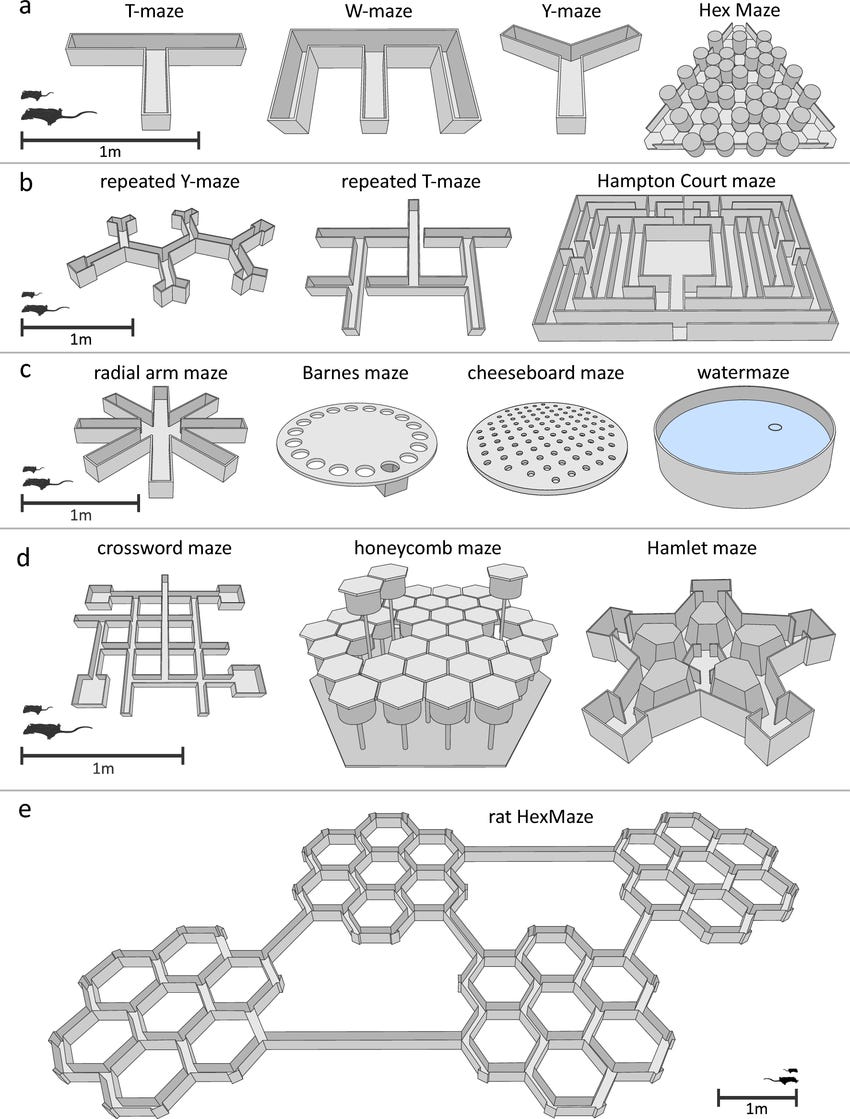

In the 19th and 20th centuries, biomedical research began to extensively employ rat mazes to investigate learning, memory, spatial navigation, and the impact of brain injuries and drugs on these abilities.

Today, we understand that rats can navigate remarkably complex mazes

In "The Secret of Words," Noam Chomsky highlights that while you can train a rat to navigate a complex maze, you can never train it to run a prime number maze—a maze that dictates, "turn at every prime number."

Rats lack the concept of prime numbers, and there is no way to impart this understanding to them.

This raises a profound question: why would humans be any different from rats in this regard? What might exist in the world that we have no concept of?

It's far from certain that life isn’t a maze beyond our conceptual grasp.

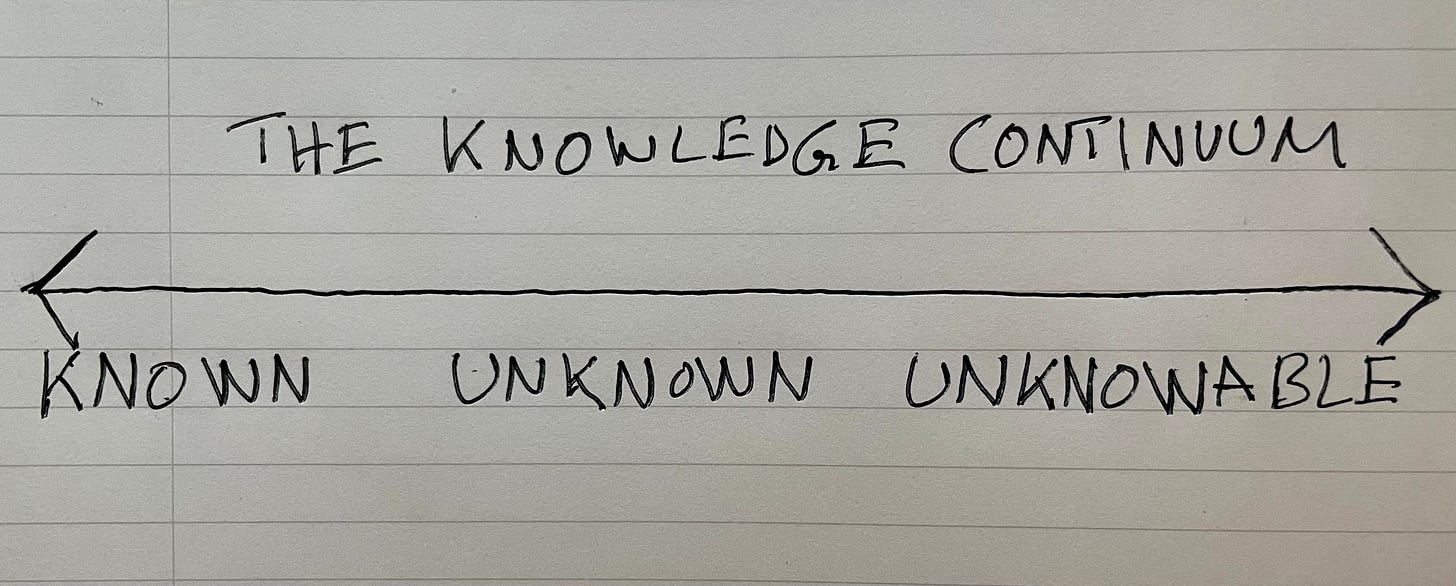

Economist Richard Zeckhauser, known for his work on decision theory, categorizes the information used to evaluate decisions as “known,” “unknown,” and “unknowable.” This framework aids in understanding how decisions can be made under varying levels of uncertainty.

The known encompasses all readily available and well-understood information. This includes facts, historical events, and future events with predictable outcomes. For example, the laws of physics, the winners of World War I, and the 16.67% probability of a six-sided die landing on 1.

The unknown refers to information that is not currently known but is theoretically discoverable. Moving information from the unknown to the known through research, exploration, or experimentation can reduce uncertainty and improve the odds of a favorable future outcome.

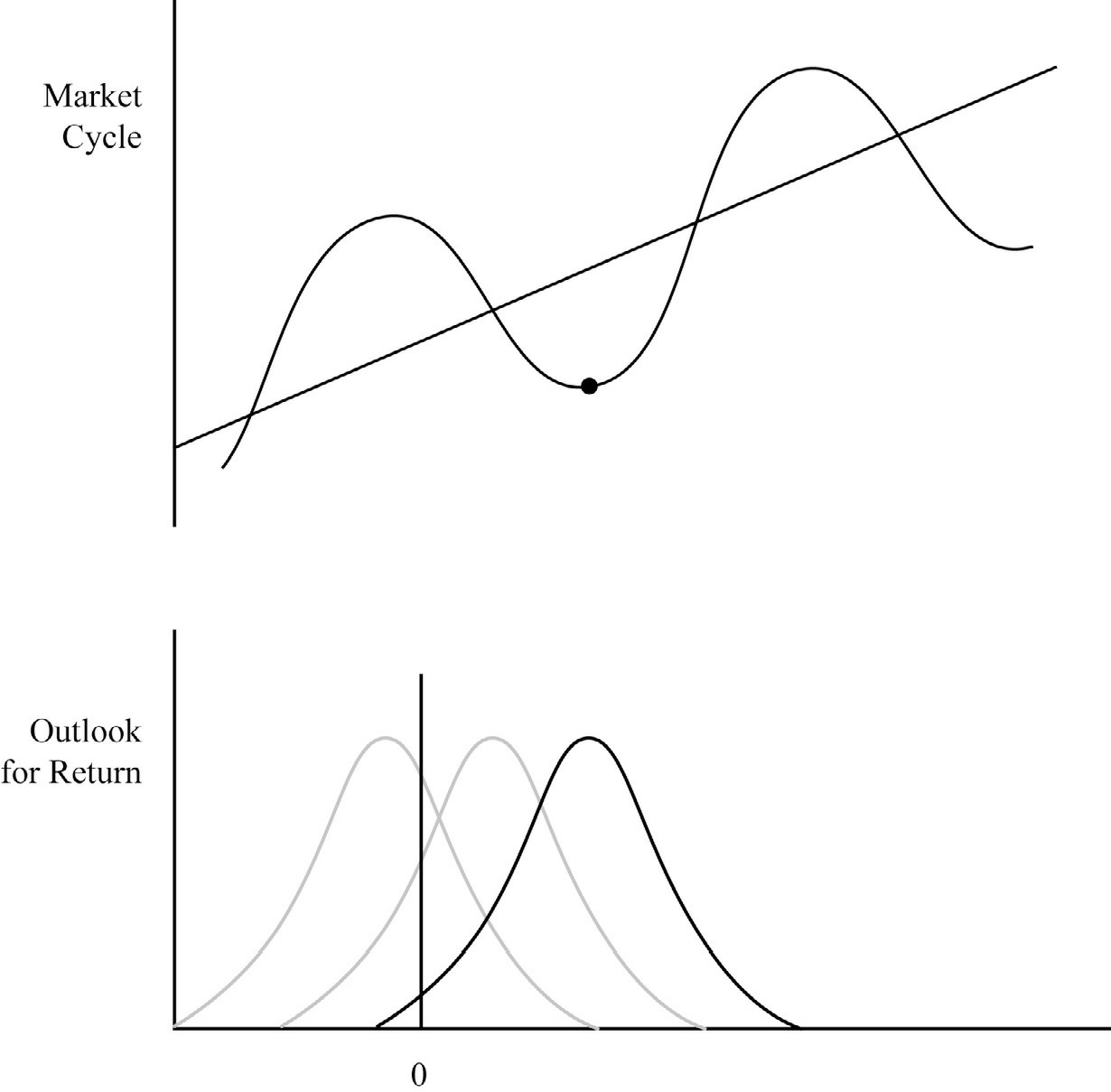

In "Mastering the Market Cycle" for example, investor Howard Marks argues that by understanding where you are in the market cycle, you can position yourself to shift your outcome curve in a favorable direction. If indicators suggest a market cycle low, more aggressive portfolio positioning can tilt the odds of higher future returns in your favor.

The unknown consists of factors or outcomes that are inherently unpredictable and cannot be known, even with additional information or research. These elements are often subject to significant randomness, complexity, or the conceptual limits of understanding. No amount of information can move the unknowable to the known. Examples include forecasting the distant future or the prime number maze for rats.

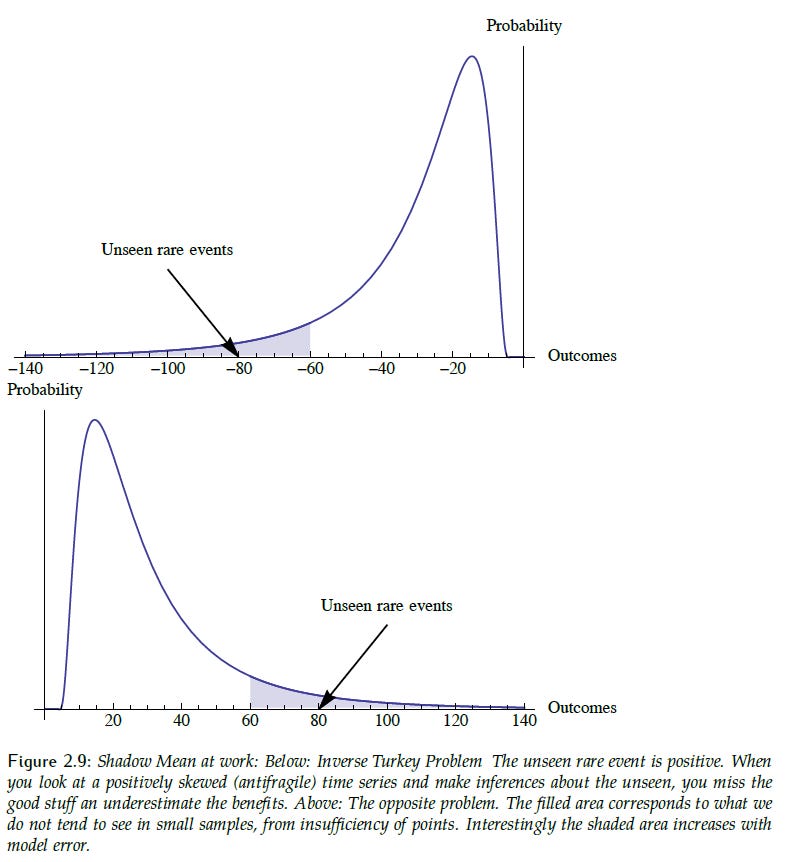

The unknown is represented in the "fat-tailed" ends of a probability distribution, also known as black swan events, as described in Nassim Taleb’s insightful work, "Fooled by Randomness."

If you can discern which category of knowledge something falls into, you can determine whether seeking more information will be fruitful.

It is our human tendency to turn to experts in the face of uncertainty. However, despite the self-confidence of academics, pundits, and talking heads, decades of longitudinal research presented by Philip Tetlock in “Superforecasting” have quantitatively shown them to be no better than chance in predicting future events within their respective fields.

Tetlock did find a small percentage of experts, known as "superforecasters," are in fact better than chance due to their use of techniques like probabilistic thinking and Bayesian updating.

So, the next time you feel like a rat caught in a scary maze, ask yourself: which category of information on the knowledge continuum am I dealing with?

![Greek stater (a type of coin) from Knossos, depicting Hera on the front and a labyrinth on the back,300 - 270 BCE [2400 x 1043] : r/ArtefactPorn Greek stater (a type of coin) from Knossos, depicting Hera on the front and a labyrinth on the back,300 - 270 BCE [2400 x 1043] : r/ArtefactPorn](https://substackcdn.com/image/fetch/$s_!8UiN!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F97117739-629a-4c83-a92d-6501cf3e25ae_2400x1043.jpeg)