The Hidden Geometry of Markets

A Gauge Theoretic Framework for Regime Driven Tactical Asset Allocation

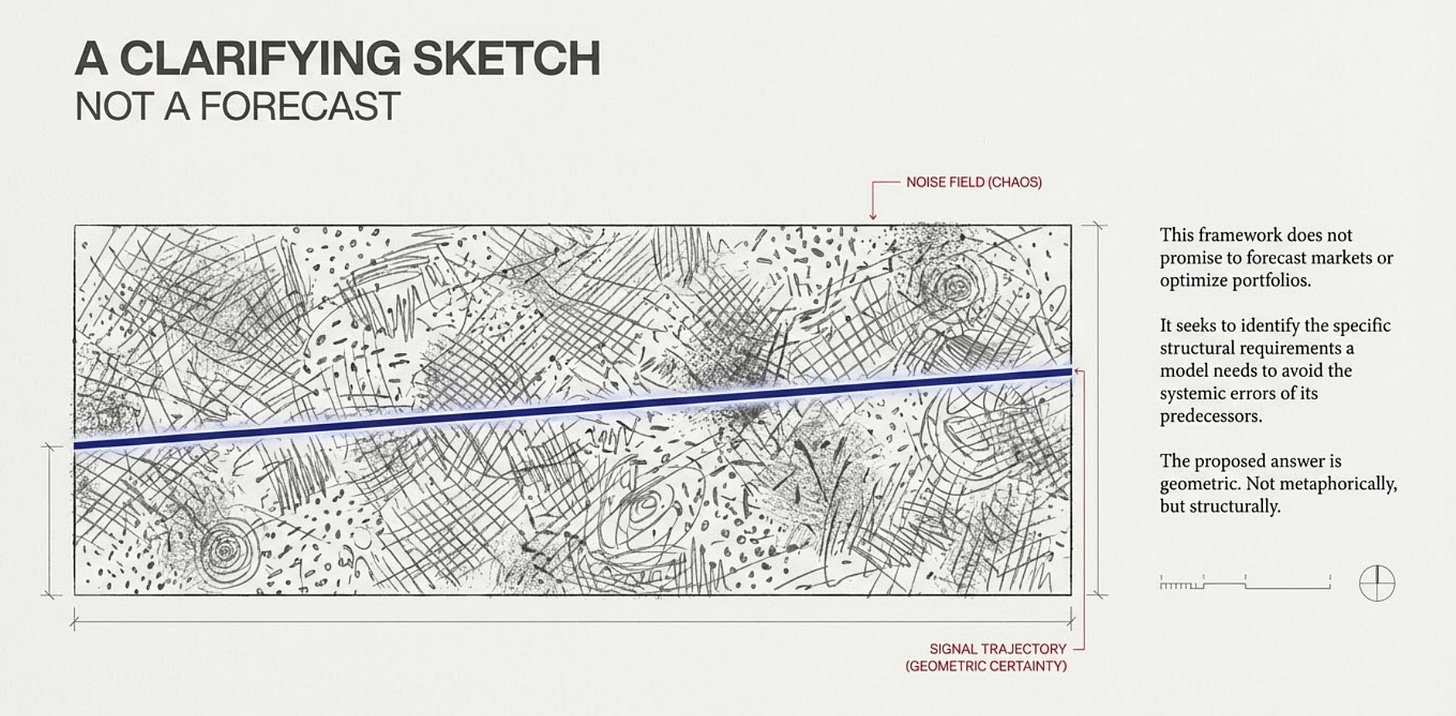

0.0 Orientation: What This Is and What It Is Not

This paper is not a trading system.

It is not a factor model.

It is not a promise of prediction.

It is a proposal about what kind of object a market is, and therefore what kind of reasoning it allows.

The central claim is simple, structural, and uncomfortable:

Markets are non equilibrium, partially observable, state dependent systems whose most important properties survive changes in coordinate descriptions. The following proposal suggests such systems demand a geometric, specifically gauge theoretic, framework.

Everything that follows is an attempt to take the claim seriously and make it investable.

1. The Error Investors Keep Repeating

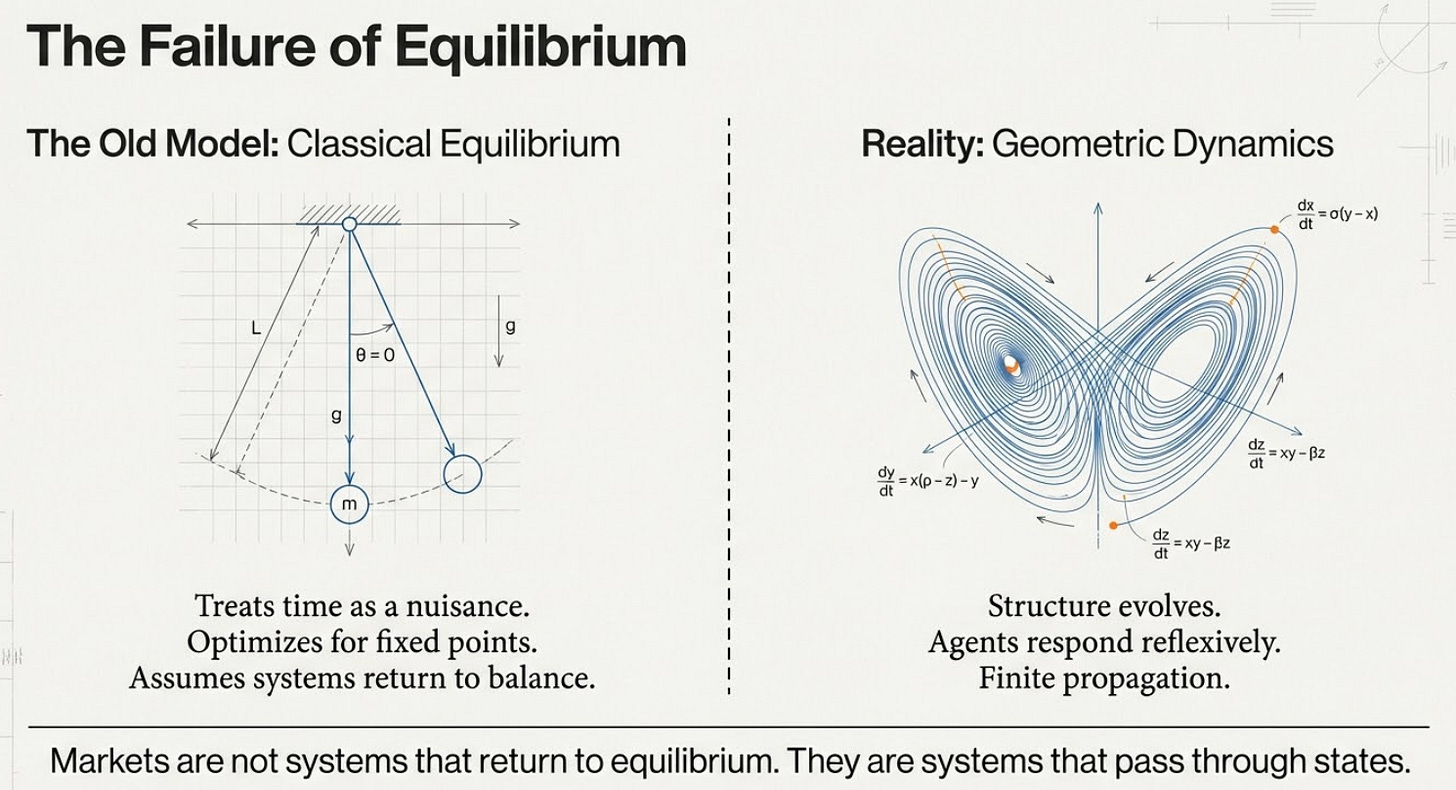

Most investment frameworks quietly inherit their intuition from equilibrium physics and static optimization. Prices are treated as objects. Risk is treated as intrinsic. Diversification is treated as structural. History is treated as stationary.

Then markets break. Not cosmetically, structurally.

Correlations spike. Volatility clusters. Liquidity evaporates. Strategies that were “diversified” fail together. Models calibrated on levels collapse when derivatives dominate motion.

These are not anomalies. They are the system revealing its true nature.

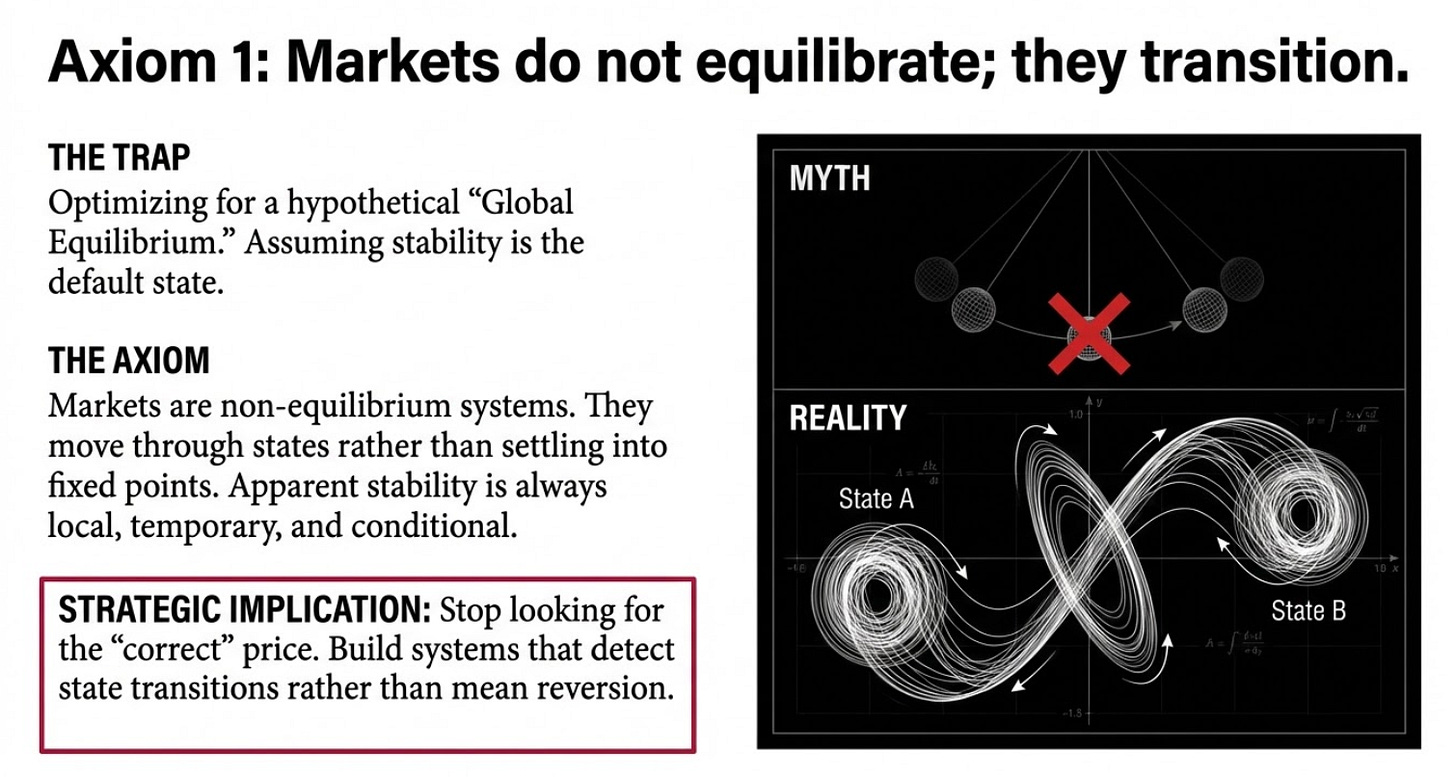

Markets do not revert to equilibrium; they move through distinct phase states, analogous to physical transitions between solid, liquid, and gas.

2. Six Empirical Market Axioms

Beware any model that ignores the following six structural market constraints:

2.1 Non-equilibrium

Markets transition; they do not settle.

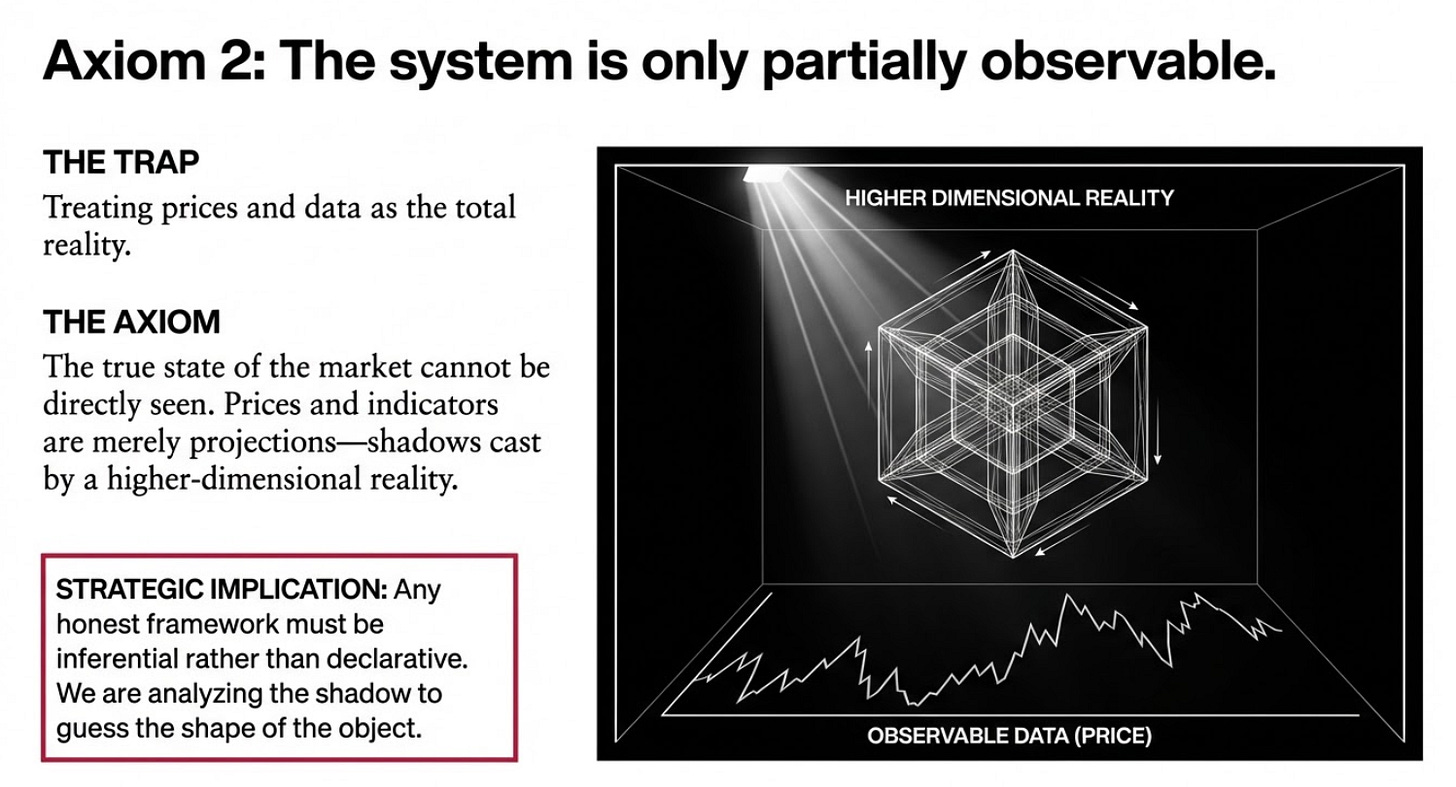

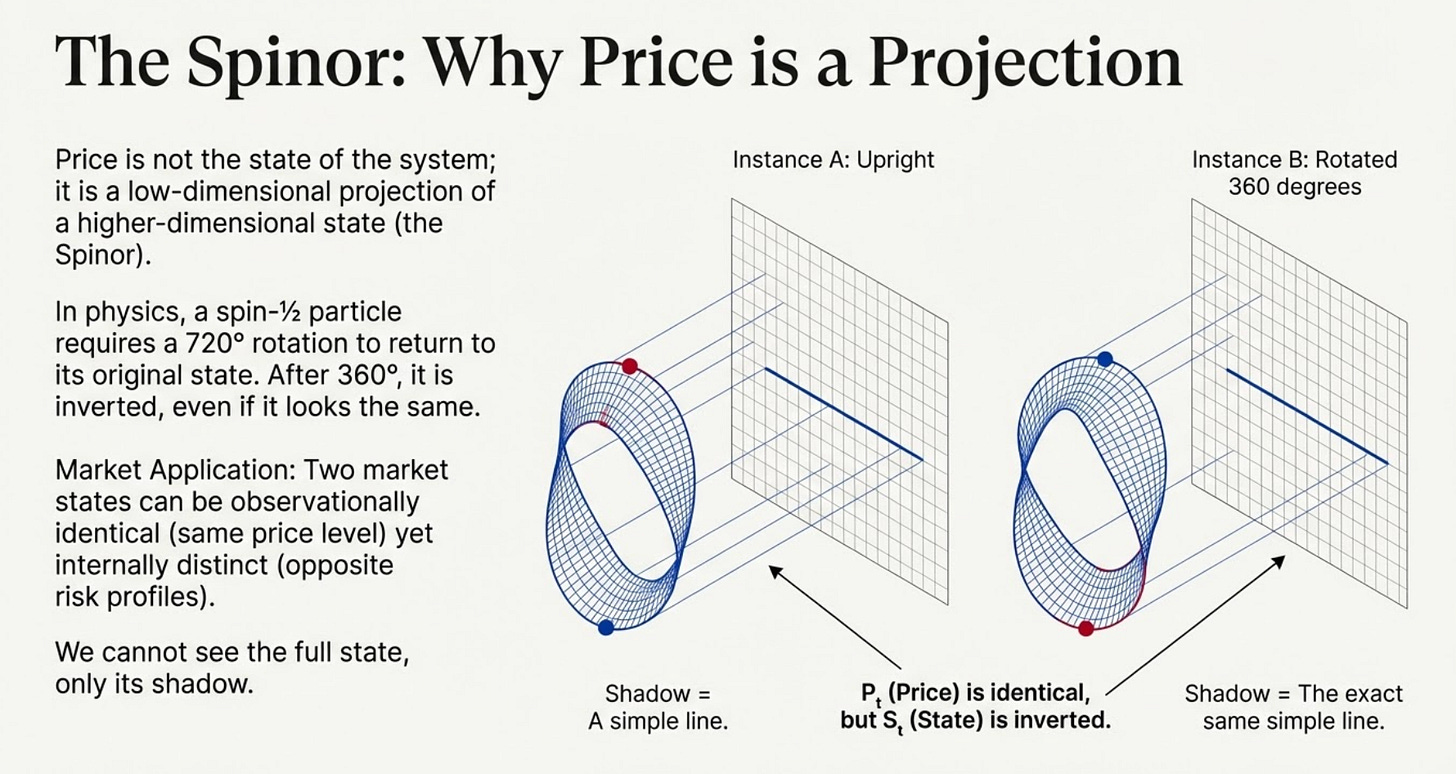

2.2 Partial Observability

Prices and data are projections of a hidden state.

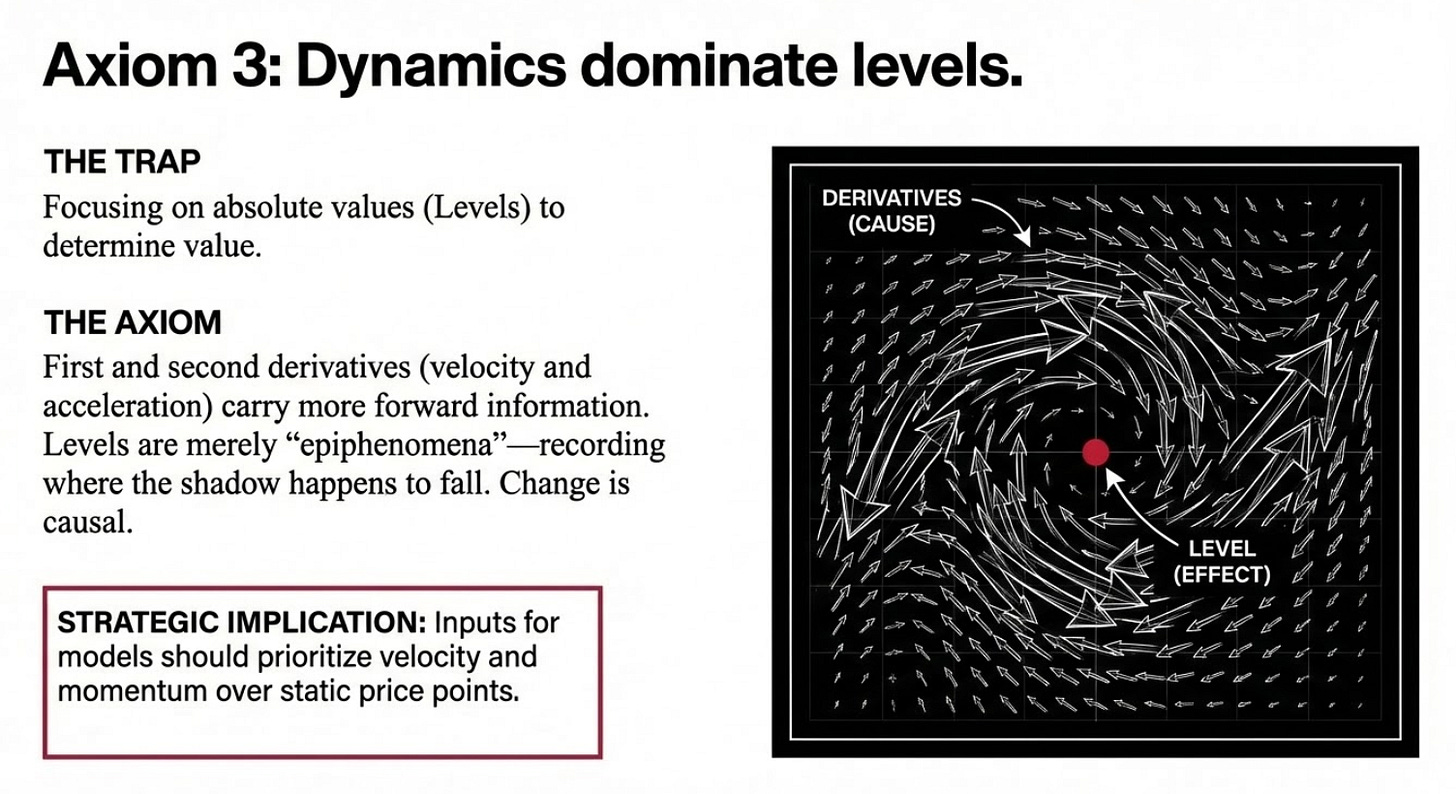

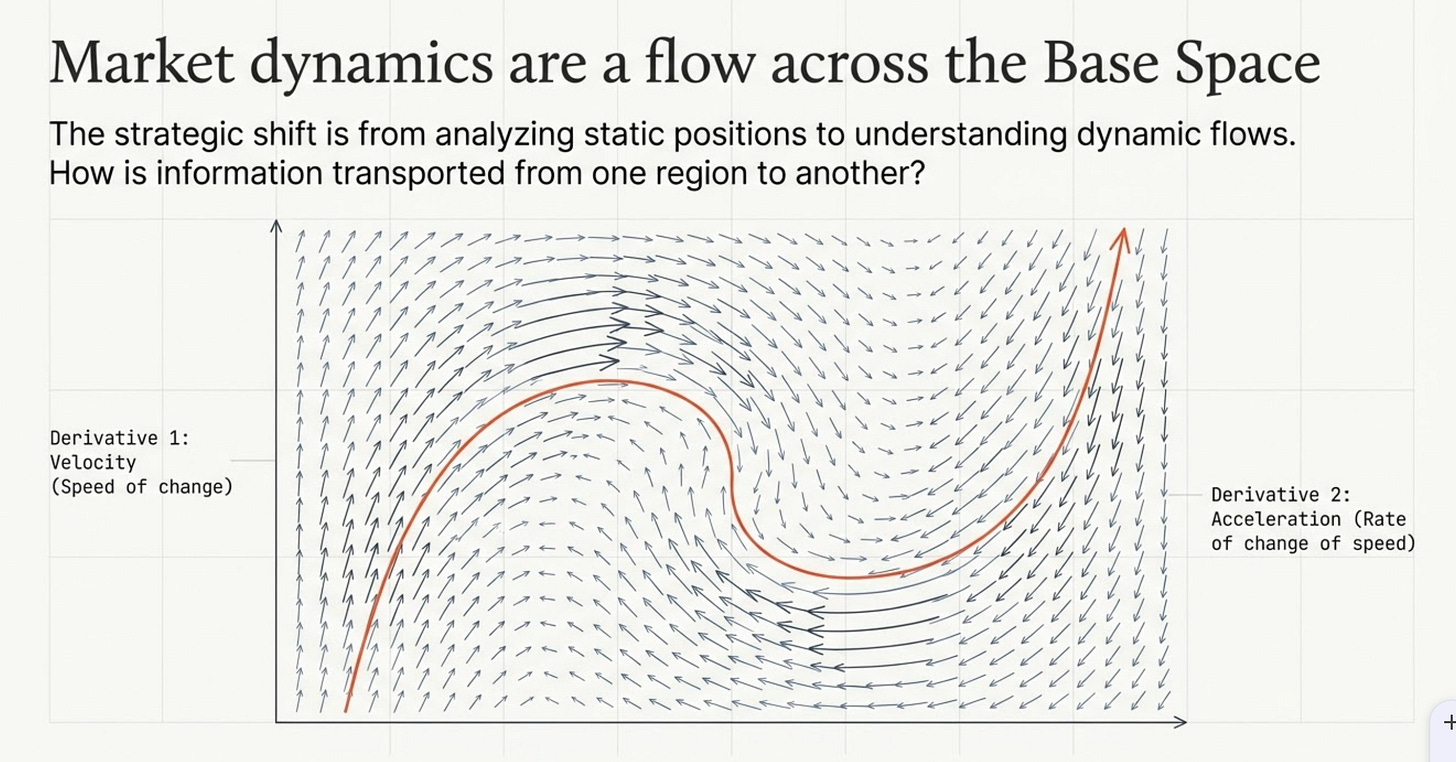

2.3 Dynamics Dominate Levels

Velocity and acceleration matter more than position.

Price levels are shadows of a higher dimensional object.

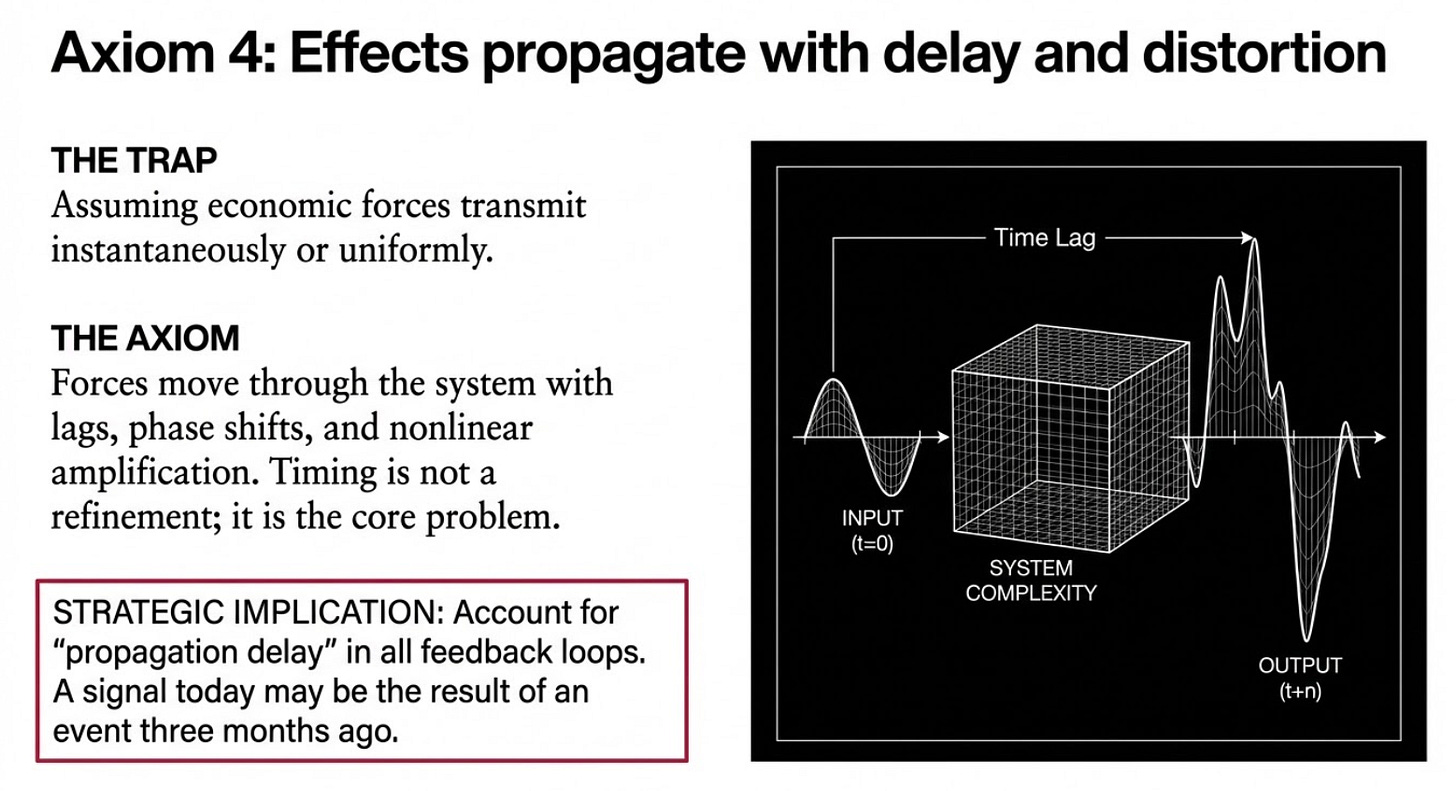

2.4 Finite Propagation

Effects travel with delay, distortion, and phase shift.

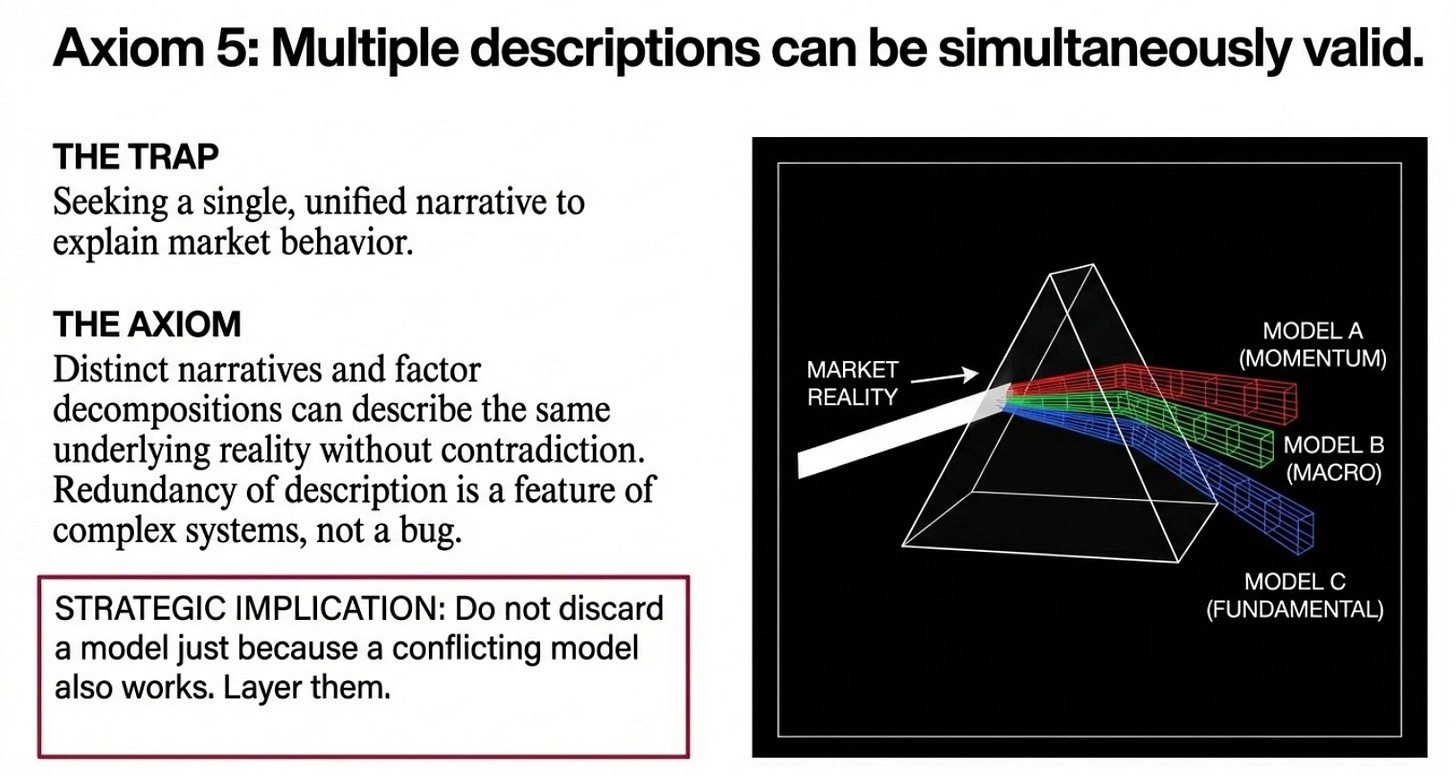

2.5 Redundant Description

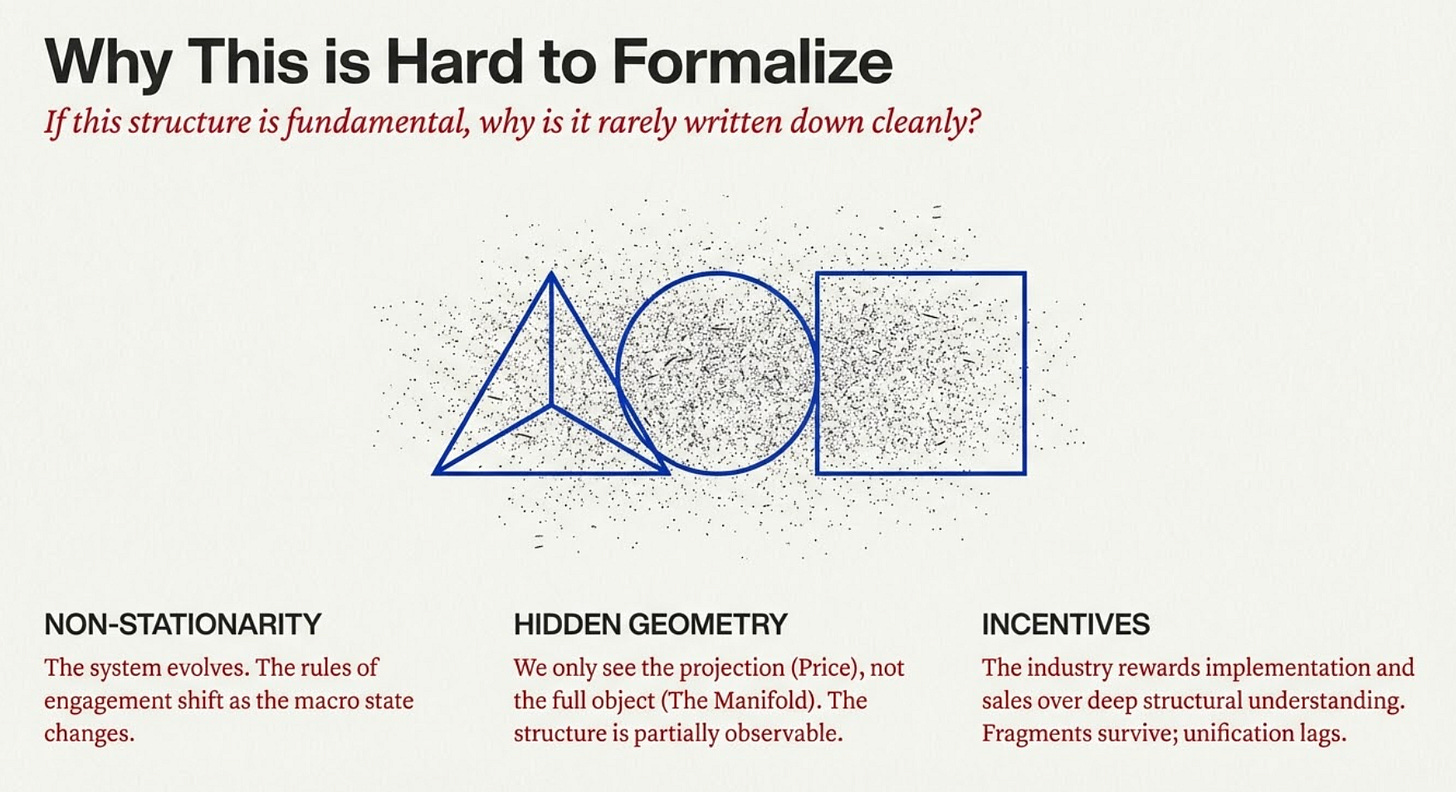

Multiple models using different gauge selections can describe the same reality without contradiction. The reality is investors are the three blind men describing different parts of a higher dimensional elephant.

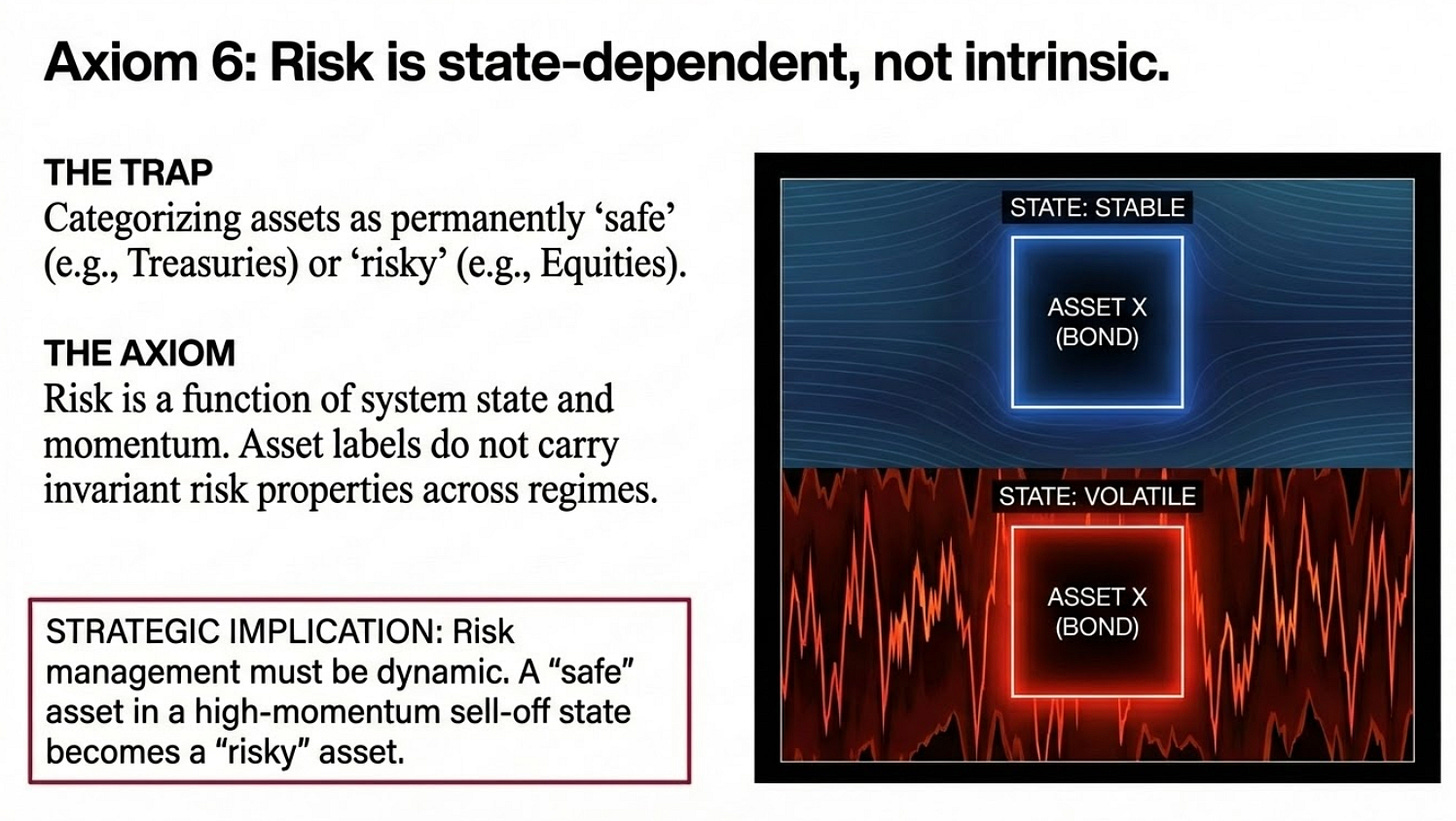

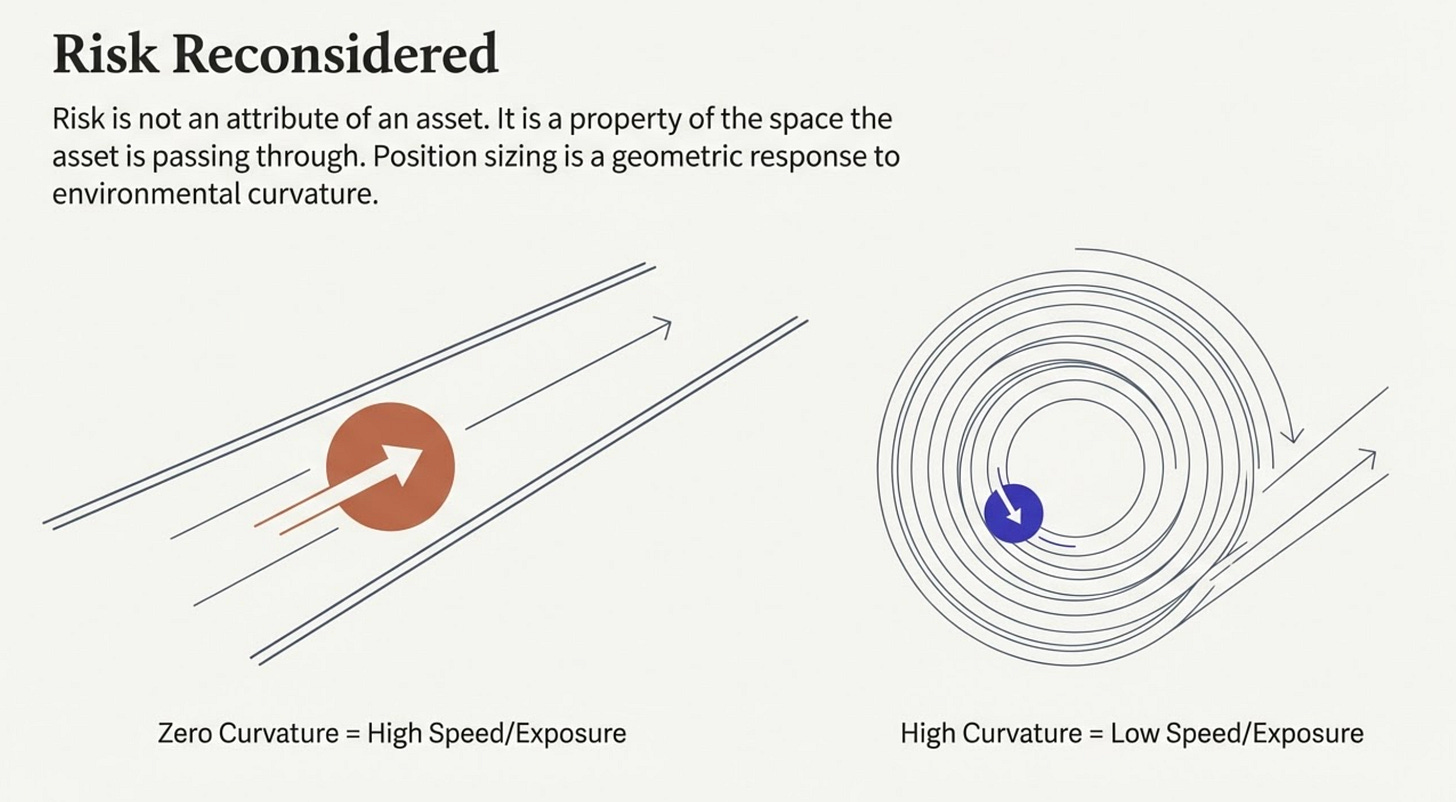

2.6 State Dependent Risk

Risk belongs to environments, not assets. The same way a cabin in the woods is more likely to burn down in a drought.

Any framework that violates these constraints may work briefly.

It will not survive stress.

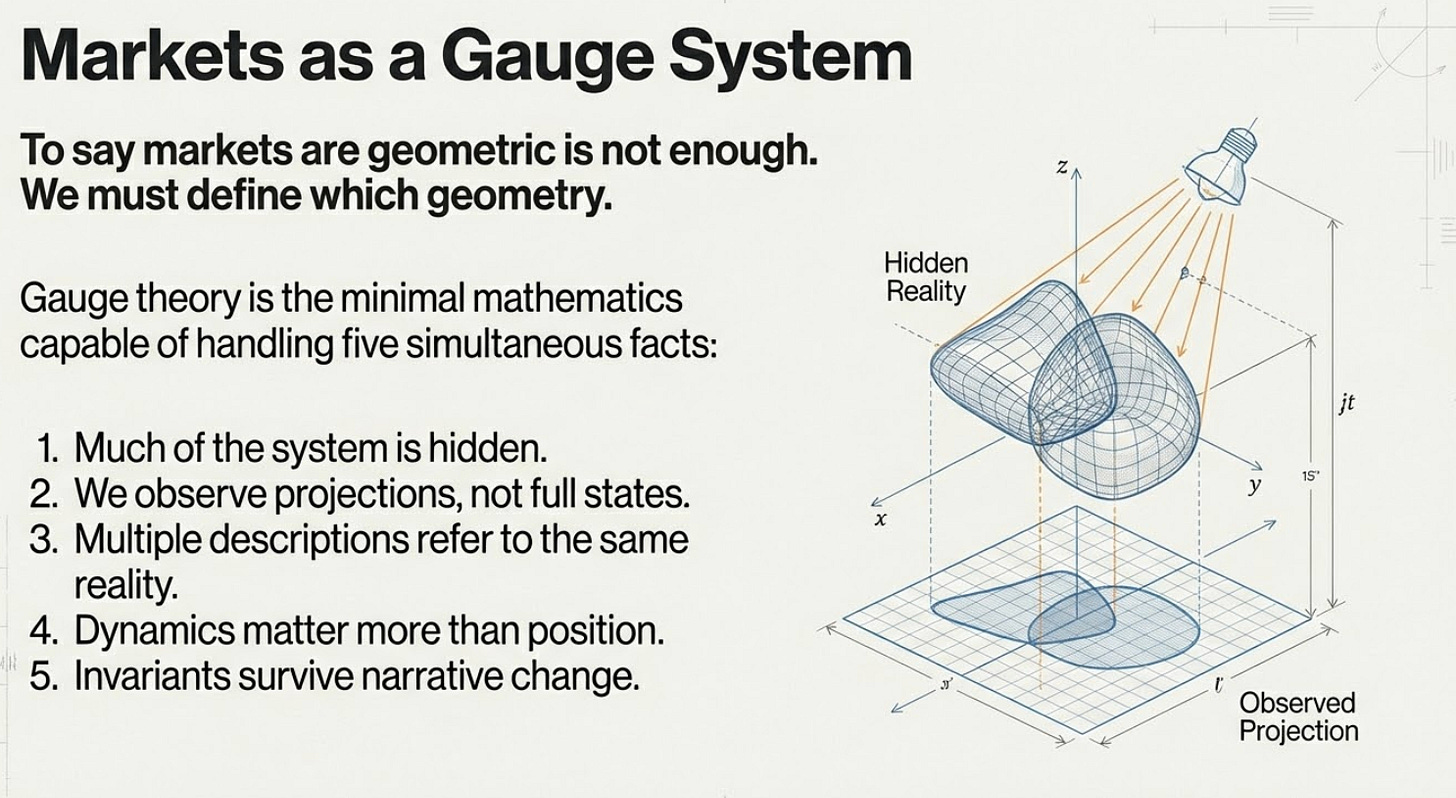

3. Why Geometry and Why Gauge Theory

Geometry is the study of structure that survives coordinate change.

Gauge theory is the study of systems where:

• Observables depend on description

• Multiple representations coexist

• Invariants persist beneath narrative disagreement

Gauge theory did not arise in physics because it was elegant. It arose because nothing else worked once equilibrium and absolute quantities failed.

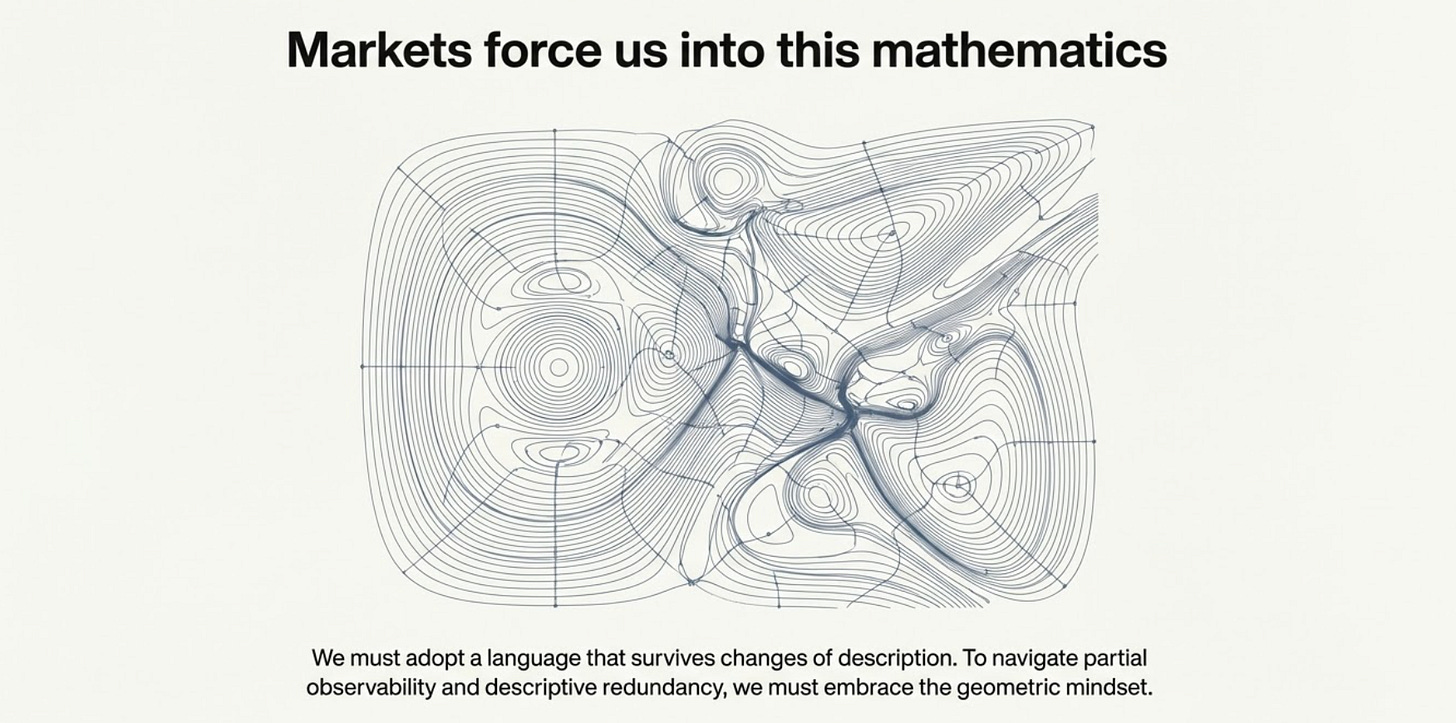

Markets satisfy the same structural conditions and so force us into gauge theoretic mathematics. That gauge theory is both elegant and broadly useful across disciplines strongly suggests it captures scale invariant structure, adding additional support for this proposal.

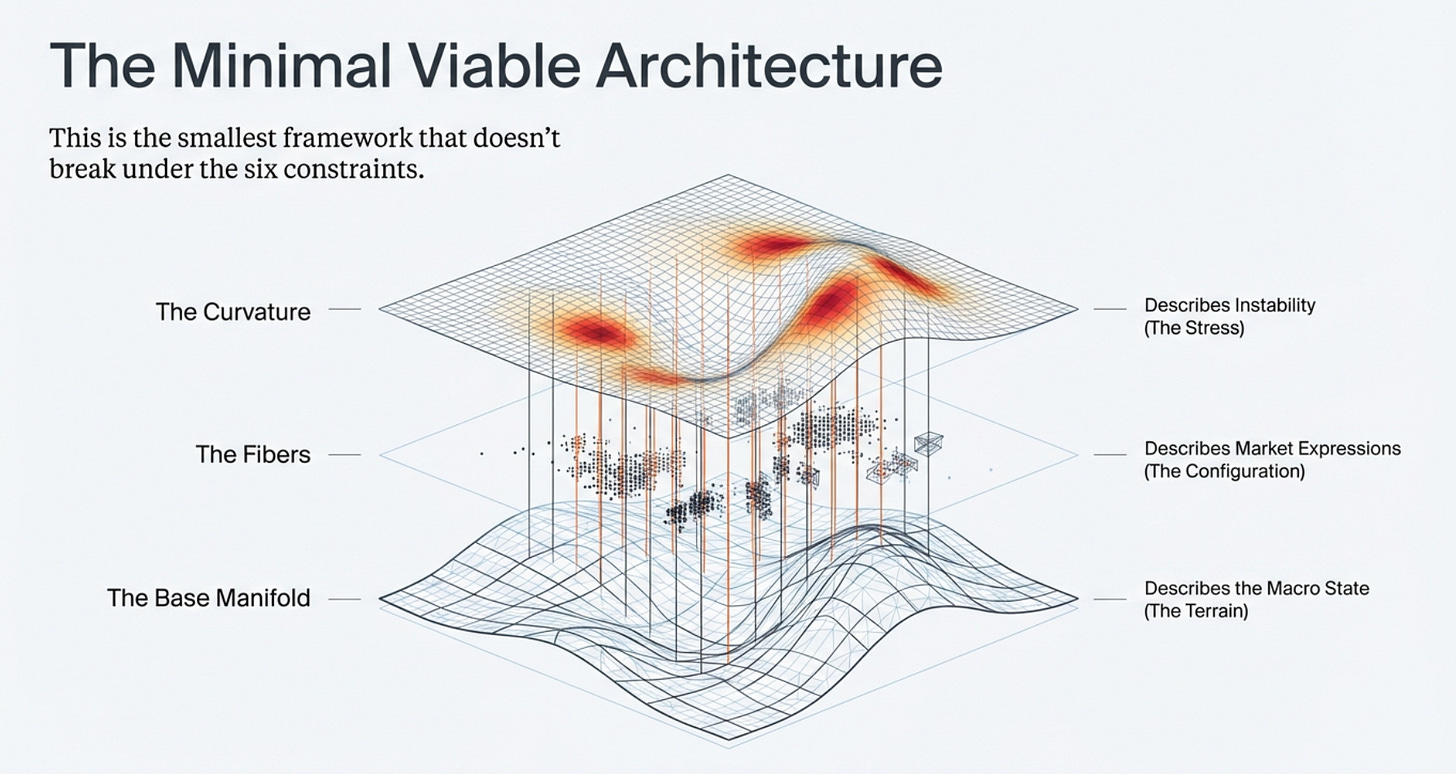

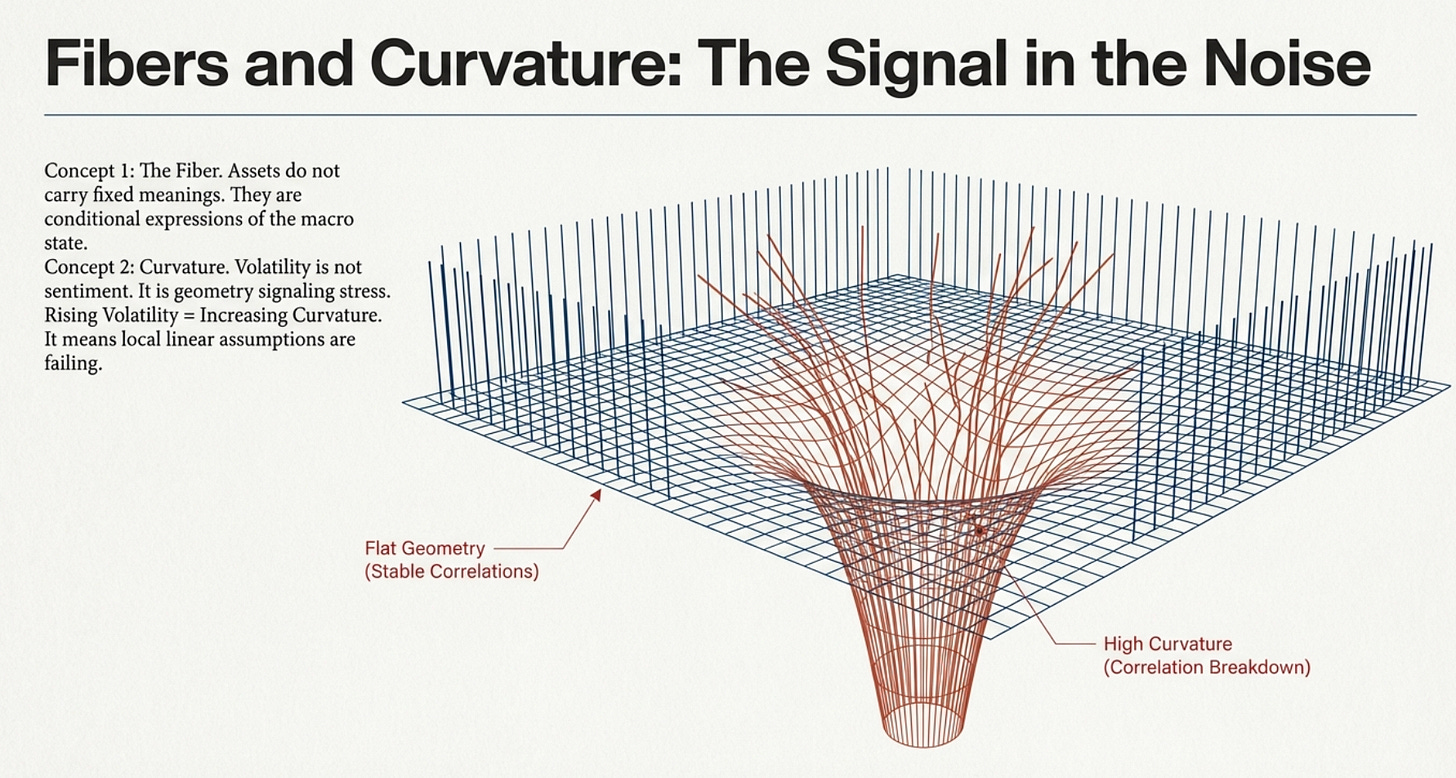

This framework proposes treating markets as a geometric system with three irreducible elements:

• A base manifold describing macroeconomic state

• Fibers describing conditional market configurations

• Curvature describing instability and risk

This is not analogy but existing mathematical scaffolding.

4. The Proposed Framework

This is the conceptual architecture.

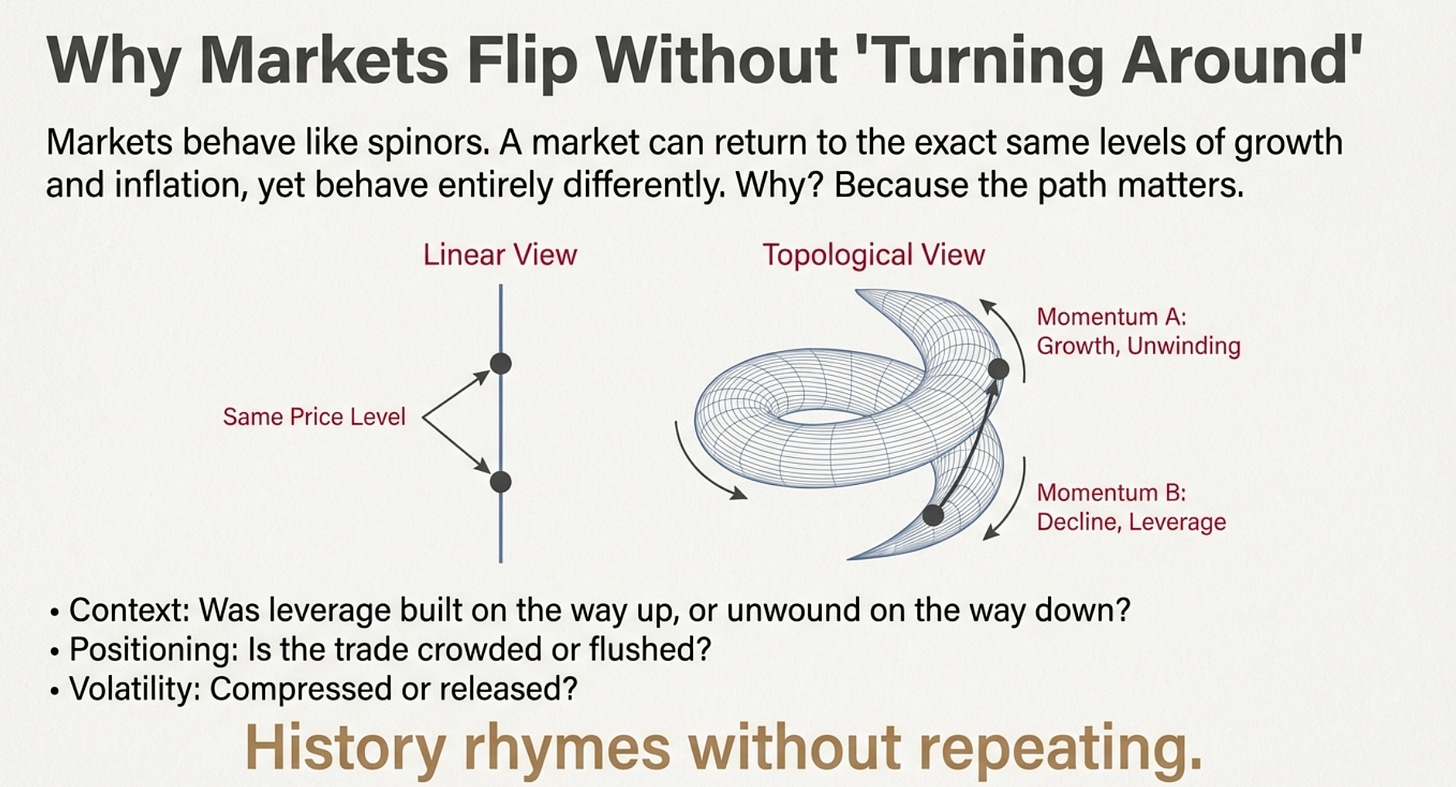

4.1 The Base Manifold: Growth & Inflation Dynamics

The global market state is defined by growth and inflation, not by their levels but by their first and second derivatives.

• First derivatives → direction of motion

• Second derivatives → pressure, transition, and instability

This defines a two dimensional dynamic, continuous macroeconomic manifold.

“Regimes” are not labels.

They are regions of this manifold plus momentum.

Two markets at the same growth and inflation levels but with different accelerations are not in the same state.

Most macro errors originate here.

4.2 The Fiber: Conditional Market Expression

Above each point on the macro manifold exists a fiber:

the space of possible prices, correlations, volatilities, and relative performance consistent with that macro state.

Assets do not carry fixed meaning.

They are conditional expressions of state.

Building on the Nobel Prize winning work of Daniel Kahneman and Amos Tversky, portfolio construction begins by defining a reference class for the investable opportunity set within a given regime and asking:

Which assets have historically exhibited coherent, stable behavior in this region of the manifold?

This is not belief in history. It is conditional inference.

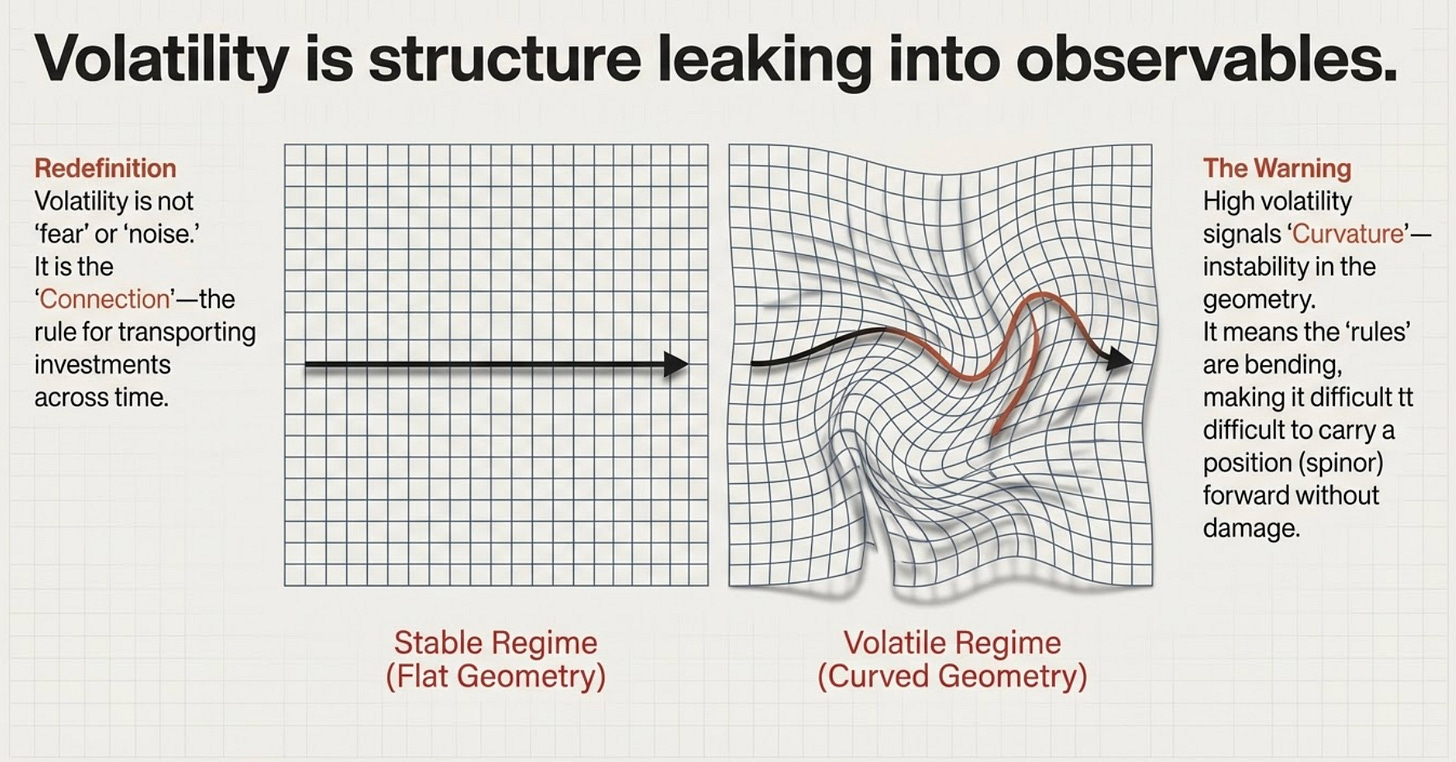

4.3 Curvature Detection

Volatility is not noise.

It is not sentiment.

It is geometry signaling stress

Rising volatility indicates increasing curvature:

• Local linear assumptions fail

• Correlations reorganize

• Historical relationships lose transportability

The volatility overlay exists for one reason: To detect when the geometry that made the opportunity set reliable is deforming.

When this signal triggers, the model does not panic. It withdraws confidence.

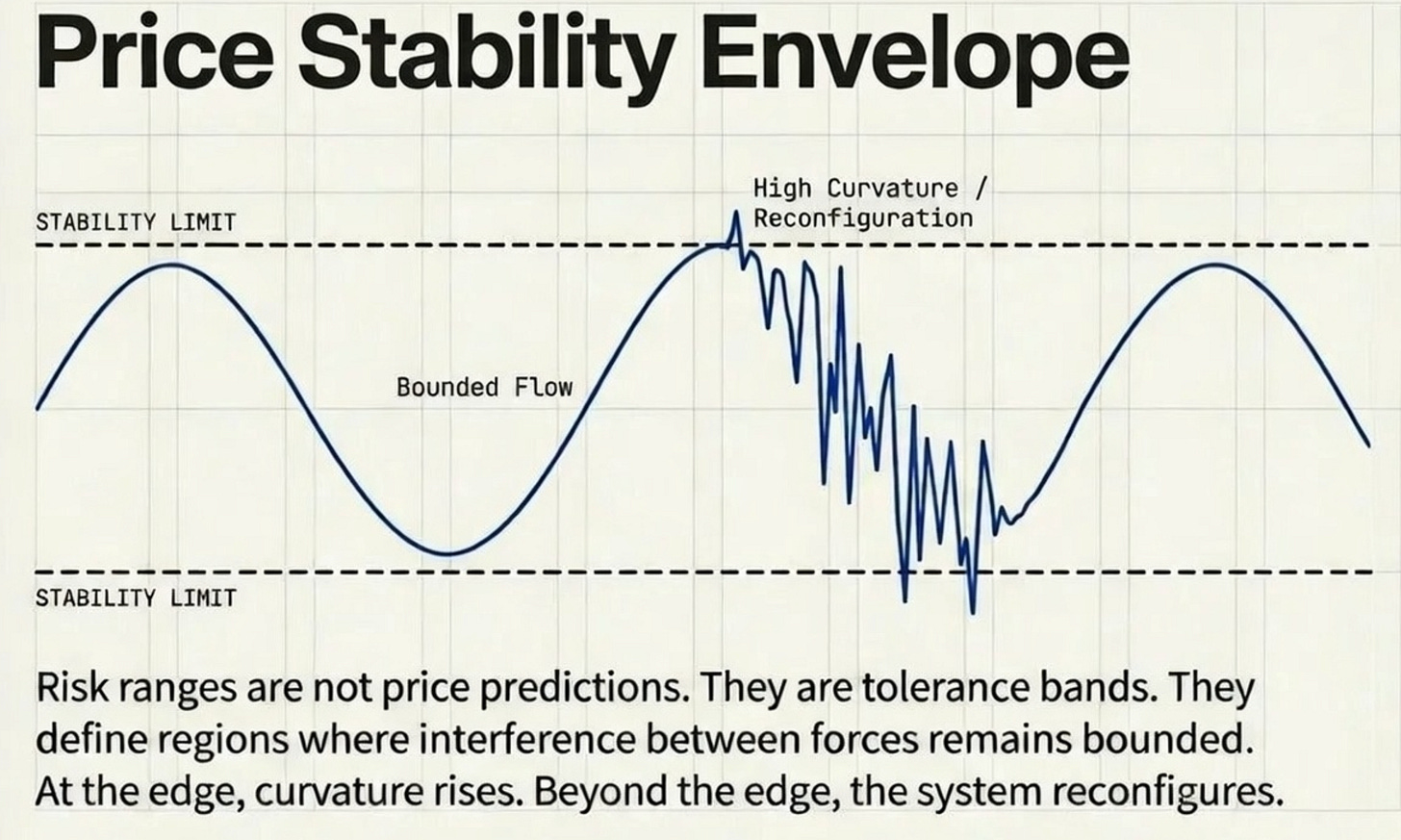

4.4 Tactical Layer: Price Stability Envelopes

Markets are global objects while trades are local actions.

For tactical entries and exits, the framework constructs price stability envelopes, upper and lower bounds within which price action remains statistically coherent given the current state and curvature.

These envelopes:

• Are volatility and volume adjusted

• Are state conditional

• Are not forecasts

They define the local, structurally stable price path across the market’s base manifold.

Price near a boundary implies asymmetry only if curvature remains low. A boundary breach implies local coordinate failure, not opportunity.

This distinction prevents most tactical errors.

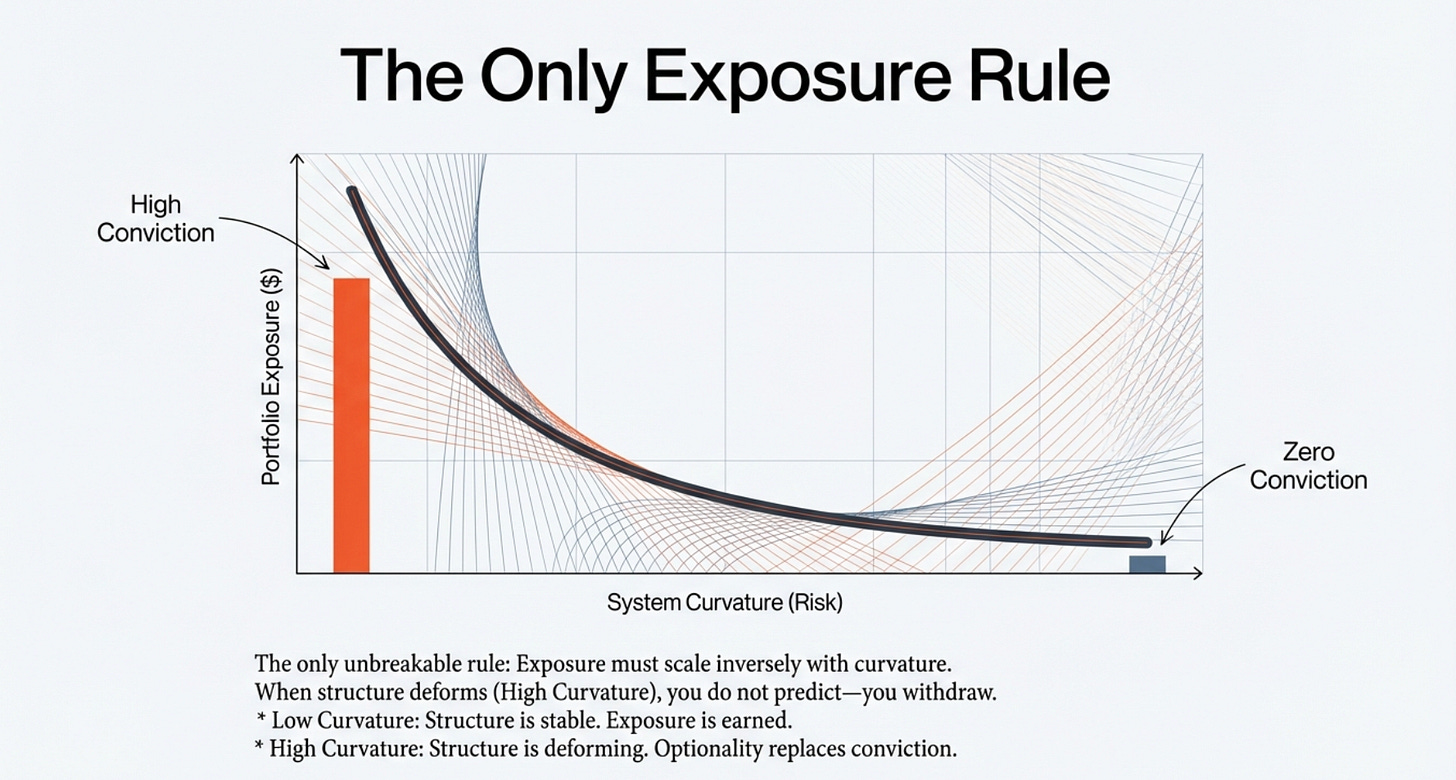

4.5 Managing Exposure

The governing principle is simple:

Exposure must scale inversely with curvature.

As curvature rises:

• Position sizes shrink

• Confidence degrades

• Optionality replaces conviction

As curvature falls:

• Structure stabilizes

• Transport becomes reliable

• Exposure is earned

When an asset’s price exits the envelope’s channel, its historical conditional return function begins to deform and collapse.

This is not discretion. It’s systematic, geometrically imposed discipline.

5. A Brief History of Convergence on the Financial Primitives

What makes this framework credible is not novelty. It is that directionally, this structure is what modern investment strategies have all been pointing at.

5.1 Bottom Up Empiricism: Jim Simons and Renaissance Technologies learned through data that levels fail, dynamics dominate, ensembles outperform explanations, and risk must scale with instability.

5.2 Top Down Macro Structure: Bridgewater Associates, under Ray Dalio, elevated regimes, propagation, timing, and state-dependent risk through mechanistic reasoning.

5.3 Reflexivity And Feedback: George Soros rejected equilibrium outright, identifying nonlinear feedback and path dependence as dominant, though without a unifying geometric formalism.

5.4 Explicit Gauge Intuition: Eric Weinstein and Pia Malaney recognized that economic quantities are often gauge-dependent and that invariants, not values, carry meaning.

These approaches did not converge by imitation. They converged because markets eliminated alternatives.

Different language with the same constraints.

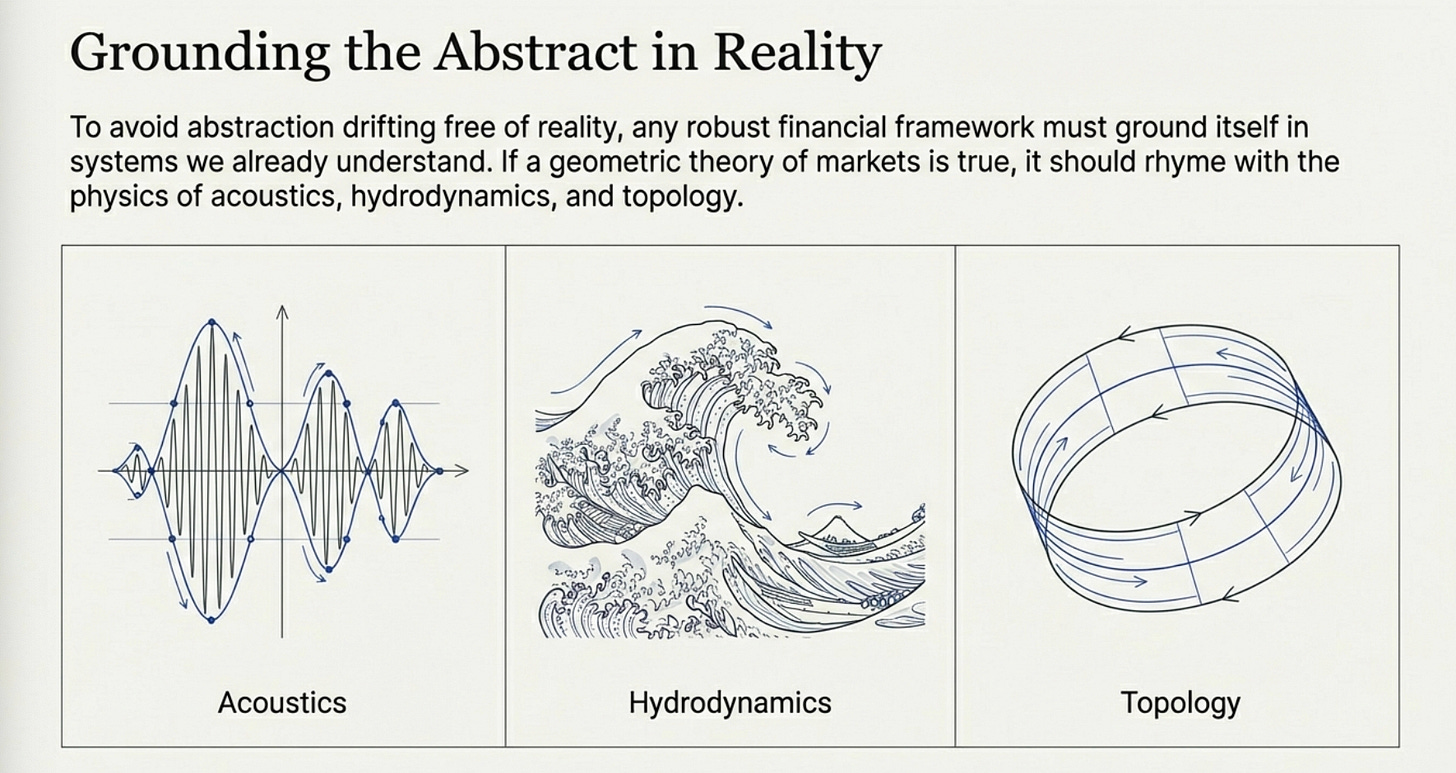

6. Sanity Check: Why This Geometry Appears Everywhere

This framework is built by adapting gauge theoretic principles from fundamental physics that have only recently been made explicit.

To avoid abstraction drifting free of reality, the framework must ground itself in systems we already understand.

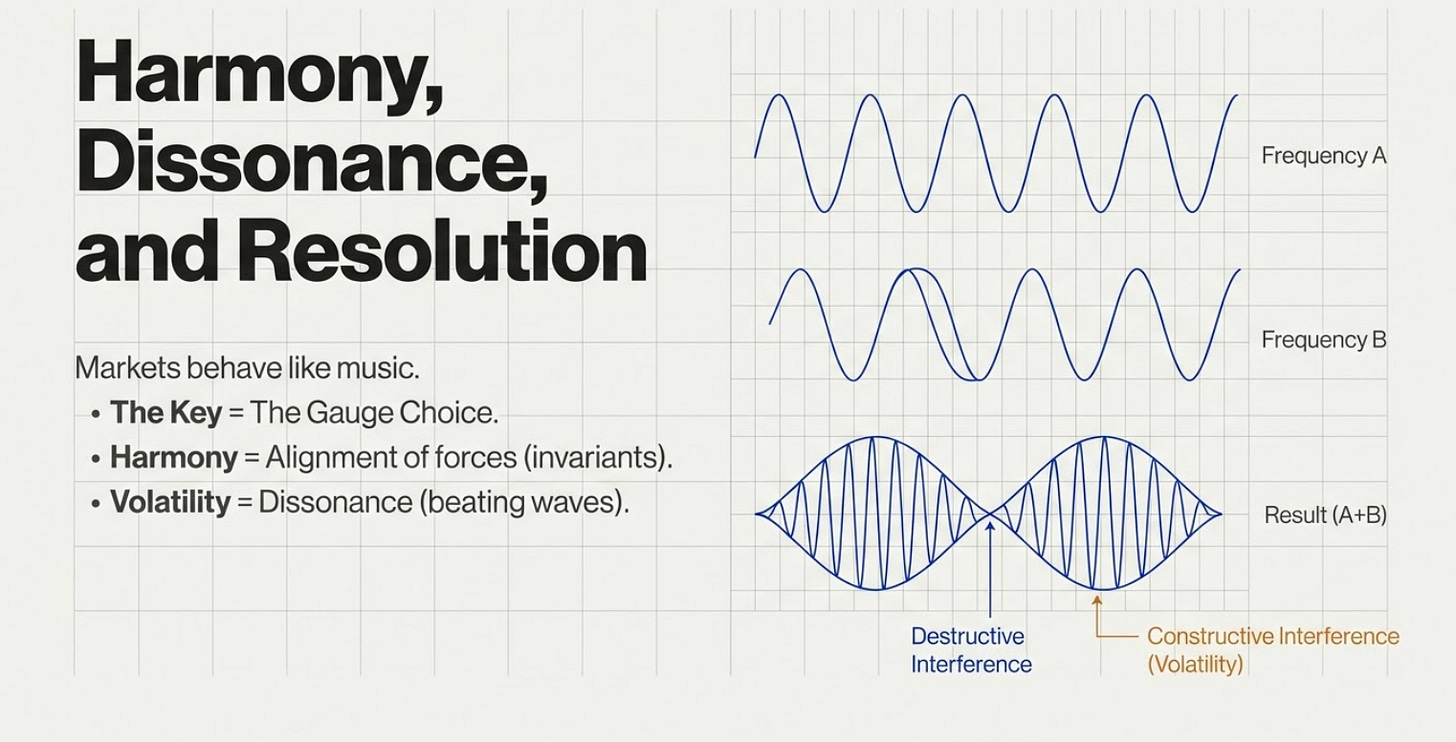

6.1 Music: Dissonance as Volatility Across Time Scales

Harmony is not a property of notes.

It is a property of relationships across frequencies and time.

When frequencies align, music resolves.

When they interfere, dissonance emerges.

Markets behave the same way.

Capital flows operate across multiple horizons:

• Short-term trading

• Intermediate positioning

• Long-term allocation

When these flows align, markets trend. When they clash, volatility appears. Volatility is financial dissonance and structured interference, not randomness.

Low curvature is harmony. High curvature is unresolved sound.

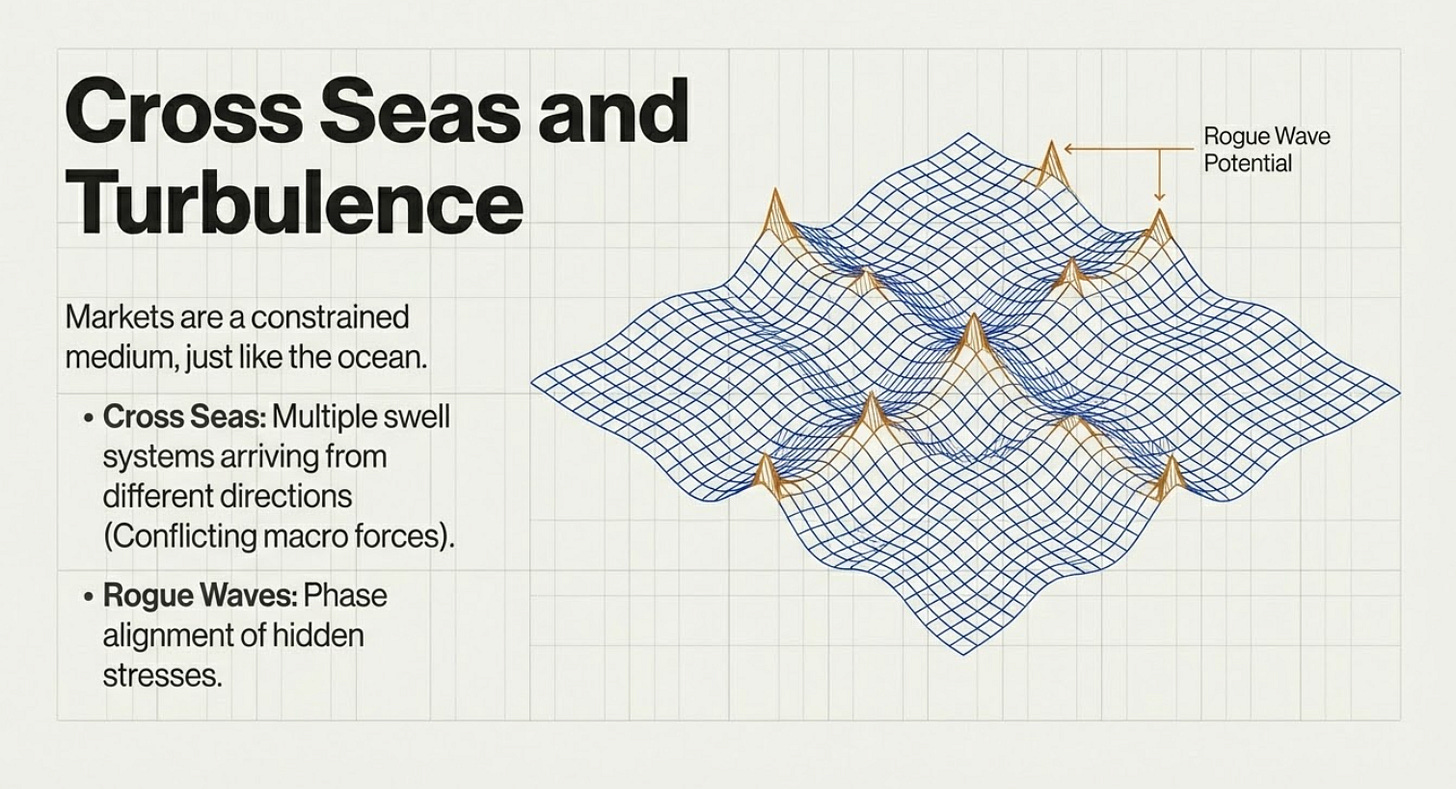

6.2 Oceans: Cross Seas and Structural Danger

Sailors have a name for one of the most dangerous ocean states: cross seas.

Cross seas arise when multiple orderly wave systems intersect. Each wave is normal. Their superposition is not.

Markets behave identically during regime transition:

• Growth signals propagate one way

• Inflation another

• Policy and liquidity introduce phase shifts

The result is volatility, correlation breakdown, and tail risk. The danger does not come from any single wave. It comes from interference. The model’s volatility layer captures additional edge differentiating cross seas from chop.

In geometry, this is curvature. In finance, it is crisis. In music, it is dissonance. In ocean faring, it is cross seas.

6.3 Spinors: Why Markets Flip Without Turning Around

Spinors are objects in fundamental physics that require a 720 degree rotation to return to their original state.

This is not a trick, it is topology. Markets behave like this.

A market can return to the same growth and inflation levels and yet behave entirely differently because the path taken matters.

Leverage was built or unwound.

Volatility was compressed or released.

Positioning was crowded or flushed.

Markets are not vectors.They are spinor like objects, sensitive to traversal, orientation, and history.

This is why:

• “Same levels” do not imply same risk

• Mean reversion fails after crises

• History rhymes without repeating

7. What This Framework Does and Does Not Do

It does not:

• Predict prices

• Eliminate drawdowns

• Replace judgment

It does:

• Prevent false confidence

• Align exposure with structural stability

• Degrade gracefully during transition

• Replace storytelling with measurement

It shifts the problem from forecasting outcomes to respecting shape.

8. Why This is Hard to Formalize

Markets are faster, more reflexive, and more path dependent than the theories we still use to justify them.

Narratives multiply.

Signals overfit.

Certainty becomes dangerous.

What survives is structure. Geometry describes what remains structurally when description changes. Rather than fear or chaos, volatility is unresolved geometry.