The Ghost in the Machine: How Neoclassical Economics Failed to Capture the Calculus of Human Behavior

When One Science Tries to Become Another

The Ghost of Newton in Traditional Economics

In the mid-19th century, a French economist named Leon Walras embarked on an ambitious mission: to transform economics from philosophical musings into a rigorous science. Inspired by the mathematical breakthroughs of Isaac Newton and the growing field of physics, Walras sought to create a "science of economic forces, analogous to the science of astronomical forces."

Before Walras, economics was more closely aligned with philosophy than science. Economic discussions were embedded within philosophical, theological, and ethical frameworks, focusing on moral principles, justice, and practical advice for trade and governance.

Living in an era of tremendous scientific progress, Walras witnessed how Newton's discoveries were being expanded upon to develop calculus—a mathematical language that could describe complex natural phenomena through differential equations. Walras became convinced that if calculus could precisely calculate the motion of planets, it could also capture the movements of human agents trading within an economy.

Walras's breakthrough came when he recognized parallels between physical equilibrium systems and economic markets. To understand this connection, imagine a large bowl with a rubber ball. If you release the ball from the rim, it will roll back and forth until settling at the bottom—a state of equilibrium where all forces acting on the ball cancel each other out. Gravity pulls the ball down, the bowl pushes it up, and eventually, it rests where forces cancel out.

Similarly, Walras reasoned that market forces would drive prices toward a natural equilibrium point. Just as physical forces guide the ball to rest, supply and demand would guide markets toward stable prices where transactions between buyers and sellers converge.

Walras's mathematical approach to economics gained momentum as subsequent thinkers expanded on his work.

William Jevons developed the concept of marginal utility, describing how a consumer's satisfaction changes with additional units of consumption. Since every consumer has different personal utility for a given good, market participants would inevitably trade until reaching equilibrium.

Adam Smith introduced the invisible hand, describing how individuals pursuing self-interest unintentionally benefit society as a whole. Through supply, demand, and competition, markets efficiently allocate resources without central planning.

Vilfredo Pareto introduced the concept of Pareto Efficiency, a state where it's impossible to make anyone better off without making someone else worse off. Pareto argued markets would continue trading until all beneficial trades were exhausted—the point of market equilibrium. He proudly declared that "the theory of economic science has thus acquired the rigor of rational mechanics."

By the 20th century, economists synthesized these ideas into neoclassical economic theory. Starting with foundational assumptions about rational consumers and producers optimizing utility among finite resources, they could mathematically model economic forces through the lens of equilibrium, from individual decisions to international trade.

Economic Balls Never Settle in Their Bowls When Markets Refuse to Stay Still

Walras’s adoption of 19th-century physics brought mathematical precision but also a critical limitation: it locked economics into a static, reductionist framework. Physics of that era focused on closed systems trending toward equilibrium, like the ball in the bowl. Walras assumed economies behaved similarly, with rational actors and predictable outcomes.

This ideological lock-in of an entire field - favoring simplicity over realism—persists in traditional economics, despite evidence of its shortcomings.

As economists gained access to better data, computing power, and research methods there was an uneasiness taking hold as they began questioning Walras's equilibrium model and its underlying assumptions.

For example, the economic “law of one price” asserts that identical goods should sell at the same price across markets absent market distorting economic barriers. Yet, post-1999 Eurozone data showed prices diverging—43% above the EU average in Denmark, more than 40% below in Bulgaria and Romania—defying equilibrium predictions.

Cracks emerged in traditional economics consideration of time scales, which traditional economic models barely consider. When they do, it's often simplified into short, intermediate, or long-term horizons.

Reality is messier: it takes time to extract crude oil, refine it into gasoline, transport it to stations, and for consumers to make purchasing decisions.

Yale economist Herbert Scarf calculated that equilibrium time grows exponentially with an economy’s complexity. The more unique items available to trade, the longer it takes for a economic system to settle. The roughly 10^10 unique economic products available today, Scarf calculated that reaching equilibrium after a single shock would take longer than the universe’s age, rendering the entire concept impractical.

The behavioral research of psychologists Daniel Kahneman and Amos Tversky undermines the "rational actor" axiom essential to traditional economic theory. Real people are poor at complex logical decision-making and subject to biases. American polymath and scholar Herbert Simon observed that people often "satisfice"—settling for "good enough" rather than optimal outcomes.

When filling up gas, people don't drive to every station in town for the cheapest price; they choose among convenient options. Time matters and is considerably more challenging to untangle then the idealized physics of billiard balls colliding.

While traditional economics models supply and demand through negative feedback mechanisms (like the ball returning to the bottom of the bowl), real economies experience positive feedback—seen in market bubbles and crashes (negative bubbles). Human behavior creates herd dynamics, and tail events can completely alter a country's economic trajectory with cascading effects.

As T.S. Eliot observed, "We can't help but disturb the universe"—our actions create ripples that amplify through complex systems in ways that simple equilibrium models cannot capture.

Without the axioms of traditional economics, it's as if the bowl's shape continuously changes over time. Economic shocks, a trade war for example, cause the bottom to develop bumps and the walls to distort, preventing the ball from ever settling. The economy may instead move from one temporary equilibrium to another. To import the language of calculus, rather then settle at an idealized global maximum equilibrium, the economy moves through a series of shifting local maximum & minimum.

Economic Metabolism: How Systems Consume Energy to Create Structure

Finally, Walras missed a key physics development: the second law of thermodynamics, which was basically unknown during his time so it’s hard to fault him.

While he grasped energy conservation (the first law), the second law—entropy increases in closed systems or said another way, “nature hates a gradient”—reveals that order decays without external energy.

The economy is not a closed equilibrium system but an open, disequilibrium system—specifically, a complex adaptive system. Closed systems trend toward maximum entropic equilibrium and cannot spontaneously generate order. Yet economic growth throughout human civilization has been a story of fighting entropy, something only possible in an open system.

Since social and economic systems are physical systems made of matter, energy, and information they are subject to physical laws. Energy enters economies to fight entropy and create order, while economies export waste, pollution, and heat. Cut off the energy flow to an economy, and disorder increases, trending toward societal heat death. If there was no water diversion to desert cities like Phoenix or Las Vegas it’s easy to imagine the entropic slide towards structural disorder.

Countries isolated by war, policy or sanctions, like North Korea, move toward a local minimum of starvation and misery as the entire structure of the system decays. The Soviet Union collapsed from economic stagnation and declining productivity in the face of excessive defense spending during the Cold War arms race. Unable to import energy and unable to produce enough economic growth domestically to fight the entropic slide of a closed system, the Soviet Union was eaten from the inside by corruption, which unintentionally accelerated social demands for political freedom and exposed the fragility of the system.

Traditional economics, locked into a 19th-century physics mindset, overlooks how such physical laws are a structural, load bearing feature of real economies.

According to a 2023 UN report, almost half of North Korea’s population is undernourished

QWERTY Markets: Path Dependency and the Stickiness of Suboptimal Systems

A significant limitations of equilibrium-based economics is its failure to account for "lock-in" phenomena, where inferior government policy, technologies or cultural norms persist despite the theoretical availability of better alternatives. Traditional economics would suggest markets naturally move toward optimal solutions, but history shows this isn't always the case.

Lock-in occurs when a technology becomes dominant and persists due to high switching costs, network effects, or ecosystem dependencies.

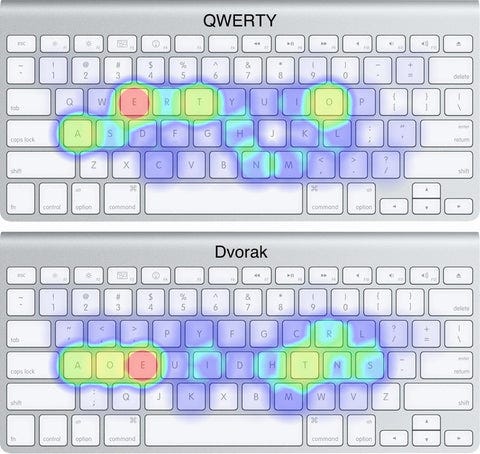

The QWERTY keyboard layout, designed in the 19th century to prevent typewriter jams, remains dominant today despite more efficient alternatives like Dvorak. ‘

The VHS format prevailed over the superior Betamax due to business decisions around movie libraries and pricing.’

Gasoline-powered vehicles have dominated transportation for over a century, despite their environmental drawbacks, because of massive infrastructure investments (gas stations), manufacturing supply chains, and consumer habits. The science fiction subgenre of steampunk imagines an alternative history where humanity continued to iterate and refine on steam powered technology rather than gas combustion.

The United States continues to use imperial units (feet, pounds, fahrenheit) despite the simplicity and global adoption of the metric system due to cultural inertia.

The Frankenstein monster that is the U.S. healthcare system is highly fragmented, expensive and inefficient compared to universal healthcare systems in other developed countries. Despite this being self evident to all participants, it suffers from lock in due to the entrenchment of special interest groups, political polarization and high switching costs.

As economic complexity scientist Brian Arthur notes, while linear systems add up to the sum of their parts (like sound and light), economic systems are non-linear, with interdependencies and feedback loops that create persistent patterns resistant to change.

Economies can thus become trapped in suboptimal temporary equilibria due to increasing returns, network effects, and path dependency—concepts that don't exist in traditional economic models based on 19th-century physics.

The Heraclitus Economy: Why You Never Step in the Same Market Twice

Just as early physics models failed to account for emergent properties in nature, traditional economics fails to capture the emergent properties of markets and economies.

To understand emergence, consider water molecules: individually, none possess the property of "liquidity," yet put a few zillion together, and liquidity emerges as a property of the collection. Similarly, several billion neurons following biological laws give rise to consciousness—an emergent property not predictable from studying a single neuron.

Economic systems, like other living systems, demonstrate spontaneous self-organization that depends on self-reinforcement—positive feedback that amplifies during favorable conditions. While negative feedback (like diminishing returns) prevents small negative changes from growing out of control, positive feedback (increasing returns) can drive growth, innovation, and change. This rich but complex mixture of positive and negative feedback magnifies differences into patterns.

Human organizations reflect this complexity. Social dynamics expand to fill all space (Parkinson’s Law), often prioritizing internal politics over goals. Resilience, not just efficiency, becomes key—efficiency locks in structure, but resilience also requires adaptability which requires flexibility. High-trust teams, diverse perspectives, and minimal coordination maximize innovation, mirroring economic self-organization. High trust networks with minimal coordination is the entire thesis of the Bitcoin network and cryptographic smart contracts.

The universe forms a hierarchy; at each level of complexity, entirely new properties appear with new laws governing them. Psychology is not merely applied biology, biology is not just applied chemistry, and economics cannot be reduced to simple cause and effect physics equations.

The concept of systems organizing themselves without central direction isn't new to human understanding. Ancient Chinese philosophy captured this phenomenon centuries ago through principles like Yin and Yang and Wu Wei ("non-action" or "effortless action"), which describe how natural order emerges without forced intervention.

“The Tao does nothing, yet nothing is left undone.” - Tao Te Ching

Greek philosopher Heraclitus noted, you can "never step in the same river twice because it is fluid, ever-changing, and alive." Economies, too, are constantly evolving systems rather than static equilibrium states. Said another way, you never step in the same market twice.

Fire Resistant Economics: Resilient Systems in an Age of Turbulence

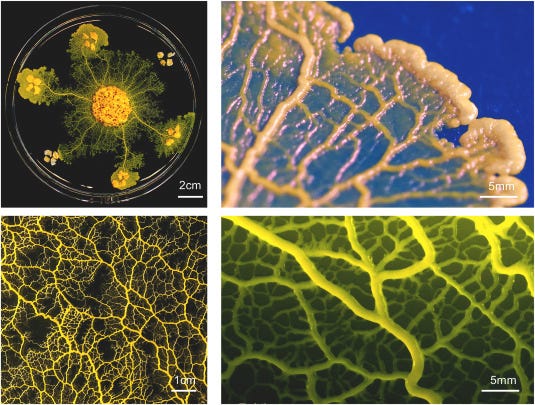

While the ghost of Newton and Walras endures, complexity economics offers a path forward. Unlike physics’s predictable orbits, economies resemble something closer to slime molds—adaptive, distributed systems where intelligence emerges bottom-up. Strategy shifts from predicting equilibria to fostering conditions for growth: planting diverse “acorns” and nurturing those that sprout.

Slime molds solve complex network problems using non-neural systems

Walras’s physics-inspired economics brought rigor but locked the field into a 19th-century mindset, ill-equipped for the non-linear, emergent nature of real economies.

The invasive, ideological lock in suffered by neoclassical economists is like the Eucalyptus tree that takes advantage of favorable conditions to grows as fast and tall as possible until it towers over its surroundings. However, eucalyptus trees grow fast but are brittle, easily toppled by wind and quick to combust during forest fires

Eucalyptus became an invasive California tree species when they were transplanted to increase the lumber supply.

To move beyond the equilibrium trap, consider the deliberate, slow and strong growth strategy of an oak tree: survive, keep costs low, explore iteratively, and embrace compounding opportunities.

The breadth and deep roots of a live oak tree means it can handle severe winds while its hard wood and thick bark make it fire resistant.

Complexity economics—rooted in open systems, iterative experimentation and adaptive behavior—better reflects reality. The next economic revolution won’t mimic physics but will embrace the messy, vibrant complexity that defines all open, living systems.

At its heart, complexity economics is more like gardening than engineering.