"If a man does not know to what port he is steering, no wind is favorable to him." - Seneca

Ancient sailors navigated oceans using stars as fixed reference points while adjusting their sails to capture whatever winds and currents nature provided. The Ouroboros Strategy mirrors this proven navigational approach.

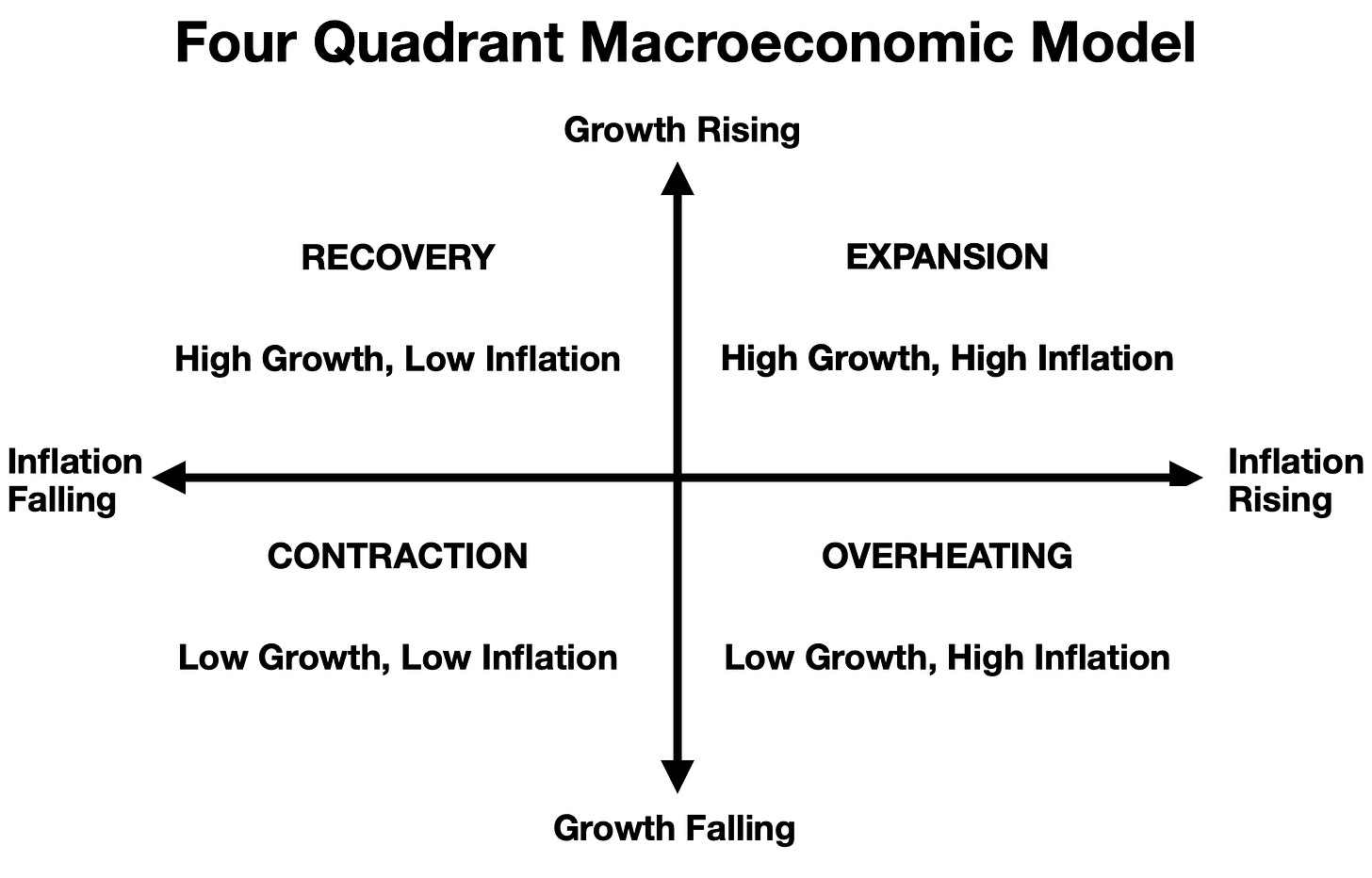

Rather than relying on discretionary judgment to predict an unknowable future, this strategy establishes fixed reference points by mapping current economic data to historical base rates—a methodology called reference class forecasting. By identifying our approximate position within economic cycles (driven by persistent behavioral patterns), we adjust asset allocation to capture momentum from prevailing economic "trade winds" of growth and inflation.

This strategy applies a well known macroeconomic framework to orient our portfolio’s within the four dimensions of motion available to the economy.

Investment Philosophy

The future is unknowable and unpredictable

Human brains are hardwired with cognitive biases, making discretionary judgment systematically unreliable

Financial markets amplify these behavioral errors, which persistently recur across time and drive market cycles

Q2 Update, July 1st 2025

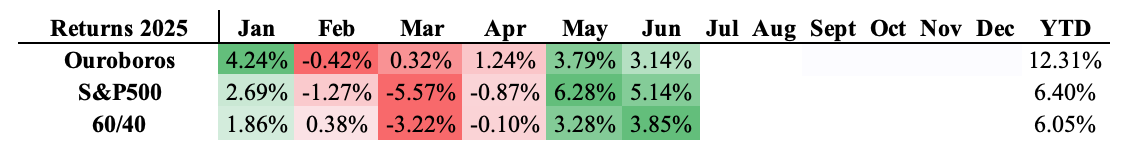

As of July 1, 2025, the Ouroboros Strategy has delivered a +12.31% YTD return, outperforming both the S&P 500 (+6.40%) and the 60/40 benchmark (+6.05%).

The strategy’s performance in Q2 was notably resilient amid broader market volatility in April. The diversified asset mix helped capture upside in May and June, outpacing traditional portfolios

State of the Economic Trade Winds

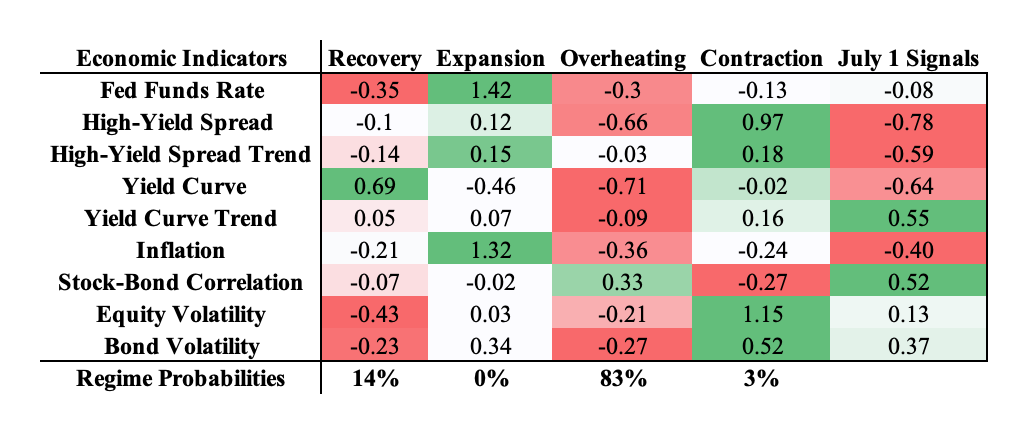

Our quantitative model analyzes 9 well validated economic indicators (standardized as Z-scores) to determine our position within the economic cycle.

The model places us in an overheating regime, where growth is expected to decline while inflationary pressures persist to the upside.

The model outputs a Shannon Entropy (H) of 0.79, indicating low to moderate uncertainty in its regime forecast.

The model outputs a Confidence Score is 0.61, suggesting moderate confidence in the regime forecast.

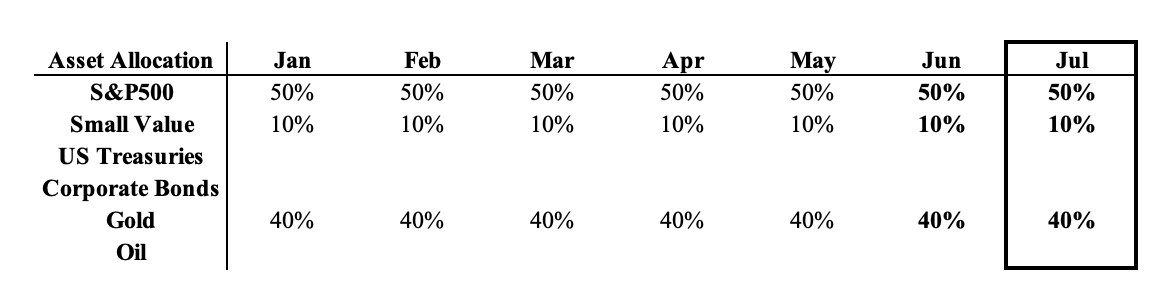

Q3 Asset Allocation

Based on our location within the economic cycle, we maintain our gold and equity-heavy allocation—a portfolio positioned for late-cycle overheating dynamics. Equity markets often, but not always, produce their strongest gains during the late stages of this regime as investors rush in from the sidelines fearing the start of a new cyclical bull market.

Risk Management: Trend Following Overlay

The strategy employs trend-following rules to limit drawdowns by exploiting empirically validated volatility clustering patterns. This approach captures the majority of upside while limiting downside risk, enabling consistent compounding from a higher base.

Trend-following applies only to assets where research supports its effectiveness: S&P 500, Gold, and Oil.

Since both S&P 500 and Gold remain above their 120-day moving averages, we maintain current allocations to these assets.