The Intersection of Life Cycles and Market Dynamics: A Strategic Perspective

How the Rhythm of Biology Informs Financial Market Cycles

Eventually you notice the whole world moves in rhythms.

Consider circadian rhythm, the four seasons, menstrual cycles, reproductive cycles, hormonal cycles, feeding cycles, migration cycles, plant growth cycles, life and death cycles, climate cycles, generational cycles, political cycles, cultural cycles, cycles of empires, debt cycles, and cycles of war and peace.

For example, consider the life cycle of the modern human.

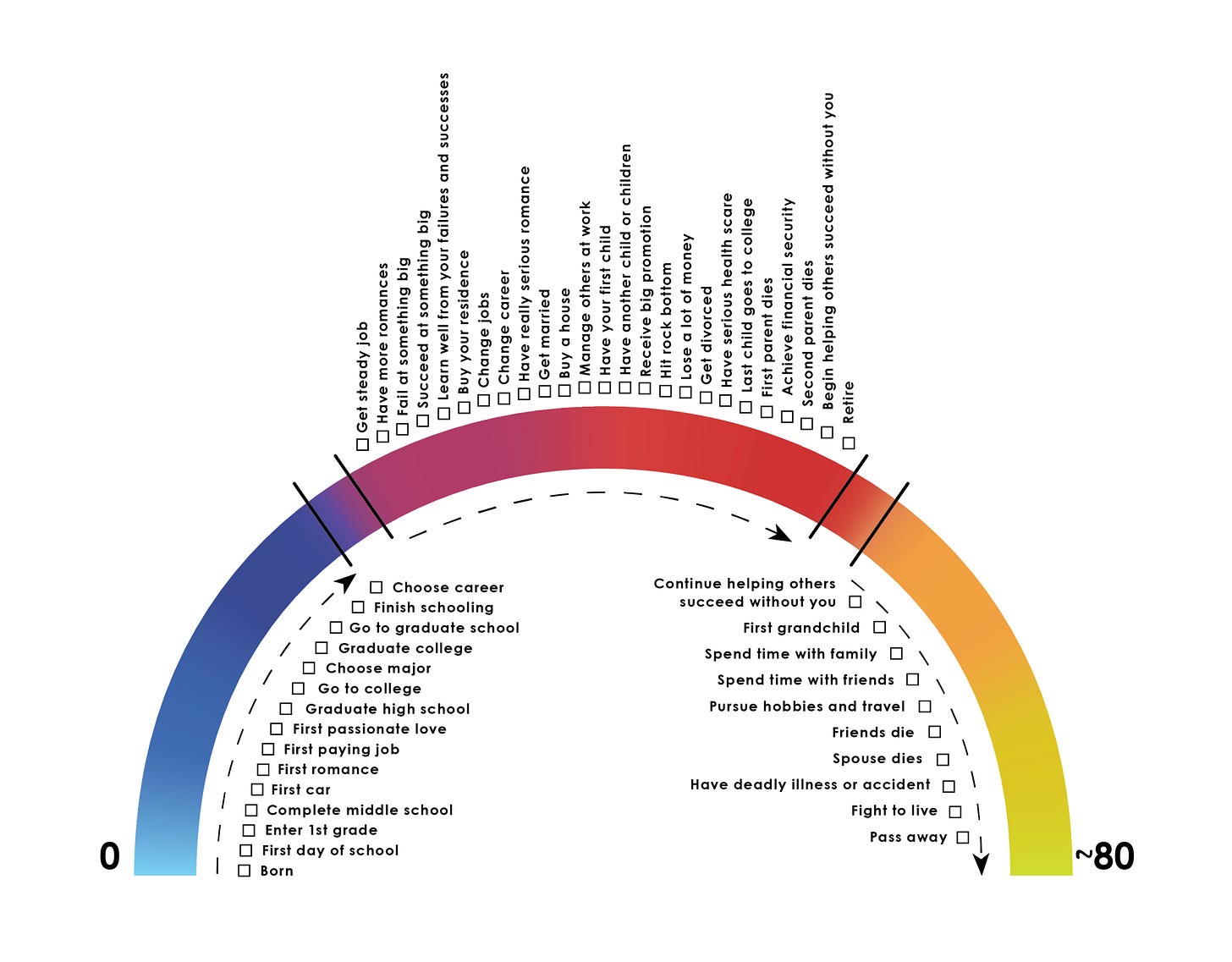

The typical life arc, from Ray Dalio's Life Journey Exercise

Not everyone experiences each checkpoint in the same sequence, and some stages may be omitted altogether. The crucial idea is that by recognizing your place in the cycle, you begin to peek around corners to better see where you are going.

This underscores the significance of studying history. It turns out everything has occurred previously. Never exactly the same but the contours often have the same feel. If you're unaware of the history preceding your birth, you will live your life like a child experiencing everything for the first time.

The ever insightful Mark Twain wrote that “history doesn’t repeat but it does rhyme.”

For instance, if you're pondering whether you should be concerned about the United States government's debt, consider examining the debt of past empires. Read about the United Kingdom's debt burden during the Napoleonic Wars and World War I in the 18th and 19th centuries; or the fiscal challenges faced by France under King Louis XVI prior to the French Revolution; or Spain's financial strain during the Eighty Years War and Thirty Years War in the 16th and 17th centuries; or Japan's debt crisis in the late 20th century; or Germany's economic struggles after World War I culminating in the rise and fall of the Third Reich; or the debt crises in Argentina and Greece—the examples are plentiful. Debt is a recurring theme throughout history.

Understand that the dead outnumber the living 14:1. Many wrote the details of all these historical events down. Find the history relevant to you and read it. You, your family or your country are never the first to go through whatever it is you are going through.

These cycles likely persist because our fundamental human nature (the human operating system/OS) remains unchanged over recorded history. Biological evolution occurs gradually, so the core aspects of human behavior have persisted. Therefore, insights from historical and classical texts, such as those by Marcus Aurelius in 150 AD about human psychology, remain highly relevant today.

This leads us to the cyclical nature of capital markets and the most important question. Why do markets exhibit cyclical behavior at all? And why is cyclicality so ubiquitous in the world?

Consider this: If the average growth rate of US GDP is 2%, why doesn't it consistently grow by 2% each year? Similarly, if the S&P 500 index returns an average of 10% over 100 years, why doesn't it yield a 10% return every year?

Why doesn’t it move in a straight line upwards? Why do market crashes and bubbles occur?

Because like history, the market is made up of people feeling feelings driving behaviors based on those feelings. When all those people feeling feelings start exchanging resources based on those feelings it becomes a market. And just like animals in the wild, those feelings careen between fear and greed. The principle aim for all living beings is to not get eaten and hoard scarce resources when your next meal or mate is not guaranteed. It’s built into the architecture of the human OS.

Like a multi-cellular organism made up of single cellular organisms, the market is a super humanoid organism made up of smaller, similar human organisms. Given its size the super organism can feel things intensely. The intense emotion of the herd when it detects danger and feels fear or detects resources and feels greed will propagate through all the people that make up the super structure.

This emotional propagation causes a behavioral stampede, creating market bubbles and crashes.

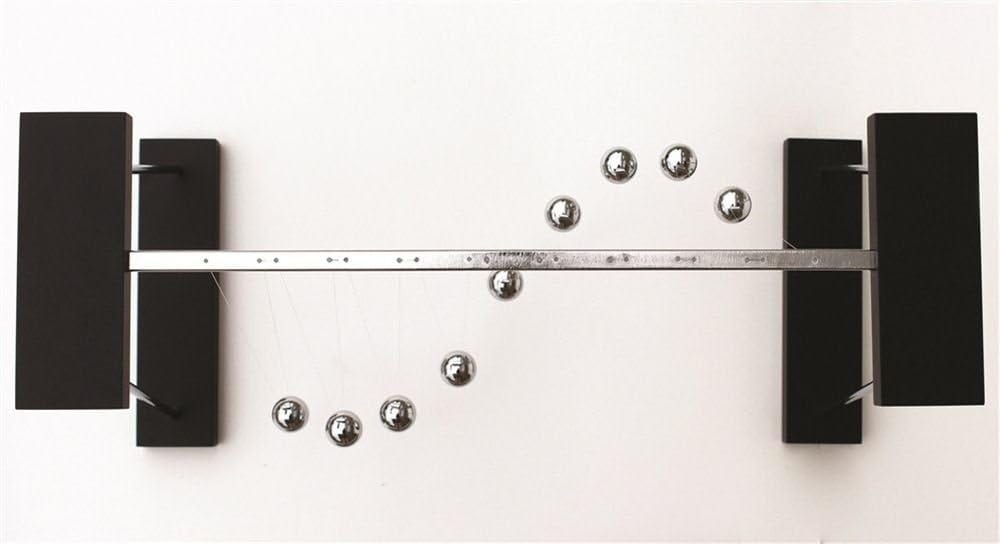

Conceptually, it functions like a pendulum tracing a sine wave over time, moving back and forth between fear and greed.

Looking down on a pendulum wave

During bubbles, greed drives the herd to frantically purchase stocks, sometimes with leverage, causing prices rapidly rise. When we see our neighbor getting rich in the stock market, even if they’re just paper profits, our tendency is to FOMO in. Eventually, the price of the stock surpasses the actual value of the business setting up the crash.

There is an analogous phenomena in the wild called a feeding frenzy, where an abundance of food triggers a competitive rush among predators and scavengers to consume as much as possible in a short time, setting up the upside swing of the pendulum. In the market, think cheap debt driving the rise of speculative asset prices.

The animals will exhibit aggressive and violent behaviors. The frenzy can become so intense it disrupts the surrounding ecosystem as anything edible is consumed out of FOMO, setting up the downswing of the pendulum.

To see the mechanics of a feeding frenzy at the microeconomic level, consider the COVID-19 supermarket run on toilet paper.

Imagine you are a toilet paper manufacturer. Investors are bullish on your company's stock, expecting robust profits due to high demand amid empty supermarket shelves. They have purchased stock shares in your company to a record all time high. Responding to this, management decides to invest in additional toilet paper production factories to meet the surge in demand.

However, just as the frenzy for supermarket toilet paper starts to ease, the increased supply from the new factories floods the market, leading to a rapid decline in demand. Now in a surplus, sellers attempt to move excess inventory by dropping the price of toilet paper to incentivize buyers.

Consequently, during your company’s next quarterly earnings report, a decline in profits is announced attributed to the lower price of toilet paper. As investors interpret this decline as a negative sign for your company’s valuation, they begin to sell their shares, driving down the stock price.

Now let’s look at the capital market cycle in more detail.

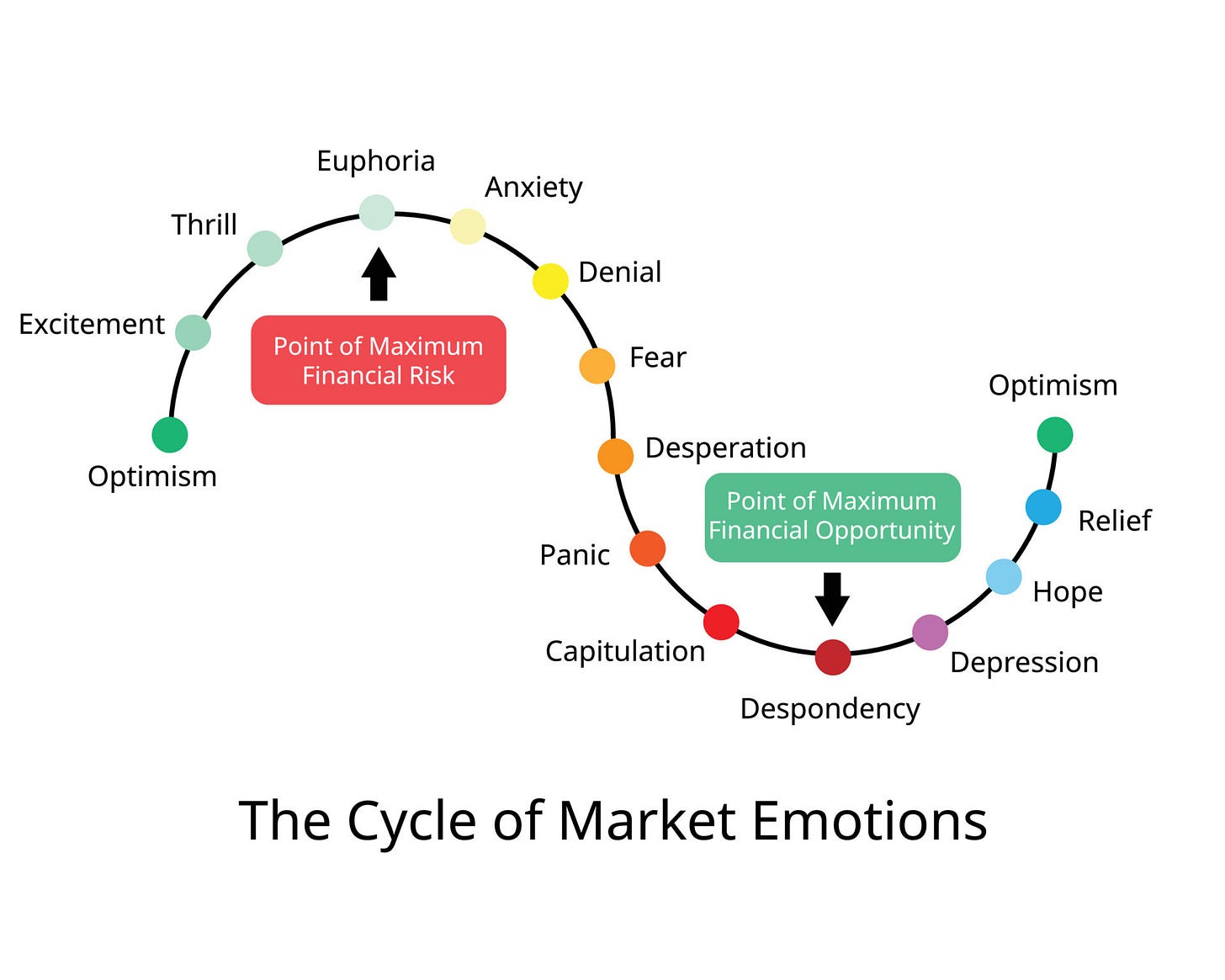

The Upswing

During the upward phase of the market cycle, expectations escalate, and investor psychology solidifies. Individuals' confirmation bias tends to highlight only positive trends, making capital more accessible for investment in appreciating assets. Those who already own assets feel optimistic about the increasing values and are encouraged to purchase more. Conversely, individuals without assets may feel pressured by the continuous price surge and decide to start buying, succumbing to the market momentum. As prices soar, caution diminishes, and investors increasingly gravitate toward riskier assets, which may experience exponential growth.

The Top

At the cycle's peak, asset prices reach their zenith, resulting in diminished prospective returns due to the significant escalation in stock prices. Consequently, risk is at its highest point, despite prevailing euphoric market sentiment. It is a critical juncture for prudence, yet numerous investors, engrossed in the fervor, exhibit tunnel vision. Overcome by the prevailing exuberance, they often overlook the mounting risks and the necessity for caution.

As an aside, it's crucial to acknowledge that a market bubble often only becomes apparent after it bursts. Even with suspicions of a bubble, witnessing continued price increases can be frustrating, especially as others appear to profit substantially. This situation can challenge even the most disciplined investors.

From my perspective, a crash is a more more definitive signal then a bubble. A pronounced market decline, such as one ranging from 30-50%, will be widely agreed upon as a downswing towards a bottom. While the downswing may persist as the market searches for its lowest point, capitalizing on such downturns tends to tilt the odds in your favor. Remember risk is typically lowest and prospective returns are typically highest at these times.

Identifying the opportunity amidst widespread panic requires clarity and conviction, as this is when potential for substantial financial gain emerges. In today's era, where information is ubiquitous, maintaining a behavioral edge is perhaps the most significant advantage an individual investor can hold.

The Downswing

Economic fundamentals start to visibly weaken. As companies announce their quarterly results, many fail to meet expectations. The media amplifies a stream of negative news, leading the public to focus predominantly on unfavorable trends. The market begins to correct itself, moving away from recent excesses, prompting investors to offload their overvalued assets, which, in turn, triggers a decline in prices. This drop initiates a reverse fear of missing out (FOMO) scenario: investors observing diminishing returns in their 401(k)s feel compelled to sell to secure their dwindling gains, exacerbating the downward price trend. Those who have incurred losses face a tough decision: to realize these losses or to invest more in a declining market, still influenced by residual euphoria. As prices continue to fall, risk aversion intensifies, with risky assets increasingly perceived as surefire losses.

During the downturn, as economic conditions worsen and asset prices plummet, the urge to sell intensifies among investors, eager to stop the bleeding.

The Bottom

Asset prices are at or near a low point. Due to a significant price decline, the potential for returns is high, and the associated risk is reduced. However, many individuals remain fearful, projecting the recent downtrend into the future due to recency bias.

Knowing that markets are cyclical, not linear, you can gaze through the fog of fear to anticipate the next turn of the cycle. These are the moments to take the big swing. With a bit of luck and conviction, these can be moments of life changing wealth generation.

Eventually, when the market exhausts its pool of sellers, the dynamics begin to shift, signaling the pendulum's swing in the opposite direction as the cycle prepares to enter its next phase change. Keep in mind that at the start of the upswing, there is still widespread pessimism in the herd and an ongoing depressed outlook in the news.

The swings of the pendulum occur because there is a symmetry built into the mechanics of life. You see it in the physics of the world, how energy and mass are always conserved as objects interact. You can’t push on the ground without the Earth equally pushing back on you. You can’t stare into the abyss without it staring into you.

“No tree can grow to Heaven unless its roots reach down to Hell” - Carl Jung

Success always carries the seeds of failure and failure always carries the seeds of success. The wild flower is predestined to die in winter but it leaves behind the seeds of the next spring flower.

In psychology, success makes you vulnerable to failure through false confidence and failure sets you up for success through the lessons learned.

Success is not a constant because life is brutal not only at the bottom of the hierarchy but also at top. At the top, everyone is storming the castle seeking your head. You must constantly fight and win against the next best competitor. Enduring repeated and sustained offenses from the best is a impossible position to maintain. And so the seeds of failure are built into success and onwards the cycle turns.

It’s the story of Icarus crashing into the ocean on melted wings. It’s the Phoenix rising from the ashes. It’s Sisyphus, who finally pushes the boulder onto the top of the mountain only to see it roll back down again, repeated forever. It’s the story of Christ’s crucifixion and resurrection.

It’s the ancient concept of Yin-Yang.

Understanding how human psychology interacts with these cycles is a critical skill for any investor. When you anticipate what the herd and subsequently yourself, the single celled organism part of the super organism, will feel in the upswings and the downswings, it can be a bit easier to hold your ground in the storm. Losing your footing amidst turbulent conditions tends towards emotional capital allocation decisions forged in fear and greed. It risks dire financial consequences for you, or at worst, your family or friends.

Investing principles are life principles because it is ultimately on us to decide how to best allocate our scarce resources of time, effort, wealth and attention to achieve our aims.

There is always a tension between outperformance and resilience. It is very difficult to have both. You can drive a car at 130 MPH only by giving up steering and control. You cannot allocate your capital like a leveraged heat seeking missile and expect to have resilience in the crash.

Whether in investing or life, being aware of your position in the cycle to peek around corners will help in keeping composure when there is the inevitable turning of the pendulum.

Lastly, keep in mind that this is simple but not easy. There is a world of difference between looking at at a picture of a snake and having a live one unexpectedly thrown in your lap.

Remember your default programming is to run for your life.