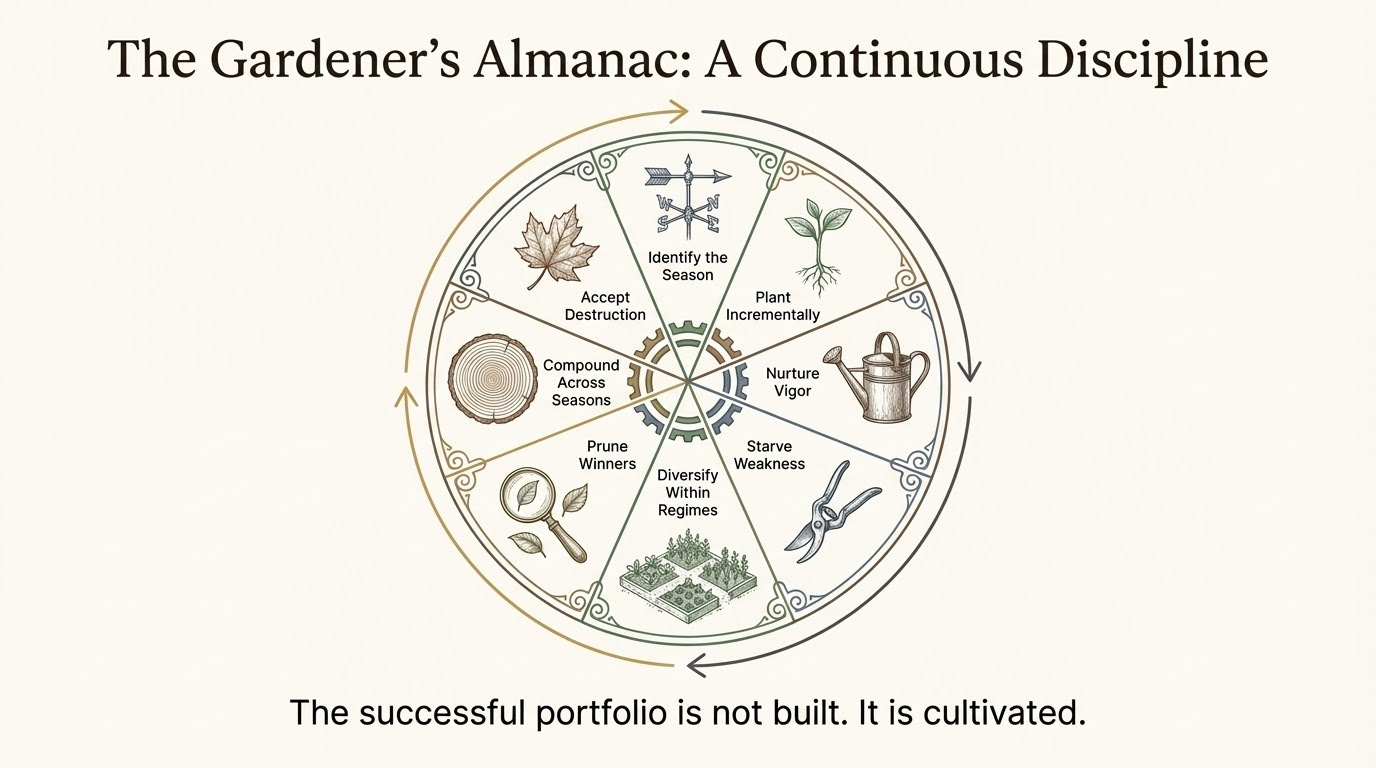

Disciplined investing resembles biology more than engineering. Like the humble practice of gardening, successful investing requires alignment with natural cycles, probabilistic thinking over rigid prediction, and the wisdom to nurture what thrives while pruning what fails. Both soil and markets are complex adaptive systems where practitioners must work with forces beyond their control, tilting probabilities rather than commanding outcomes.

This paper proposes an investing methodology that combines seasonal asset selection with aggressive position management, pressing winners while ruthlessly cutting under performers and reallocating the capital.

This approach builds a portfolio that captures the benefits of concentration by betting only on winners. When failed capital is redeployed into historically strong performers uncorrelated with current positions, the portfolio simultaneously gains the benefits of diversification.

In short, the strategy paradoxically delivers both concentration and diversification while exploiting the power law distribution of outcomes through repeated, high probability bets on capital growth each season.

First Identify the Season

A season is a recurring pattern in how energy distributes through a system. In nature, Earth’s axial tilt creates predictable cycles of solar energy concentration that life evolved to exploit. Plants store energy in roots and seeds before winter, deploying them for growth when warmth returns. This constraint isn’t about effort or desire, it’s thermodynamics. Winter soil lacks the thermal energy required for germination and photosynthesis. No amount of will can make a seed take root in frozen dirt.

Markets move in similar cycles and seasons. Capital flows through asset classes in recurring patterns, like solar energy gradients. Yet modern investors routinely expect returns from assets mismatched to the current macro regime, believing price will rise on narrative and conviction rather than seasonal constraints.

Market seasons are defined by structural constraints; the interplay of inflation, growth, and interest rates that shape which assets can thrive. Growth stocks historically outperform in low rate, low inflation, stable growth regimes. Commodities flourish in inflationary, strong growth environments. Bonds excel in disinflationary or recessionary conditions.

The fundamental lesson: growth depends on planting the right seed at the right time in the right season. Identify your market season first, then select assets accordingly.

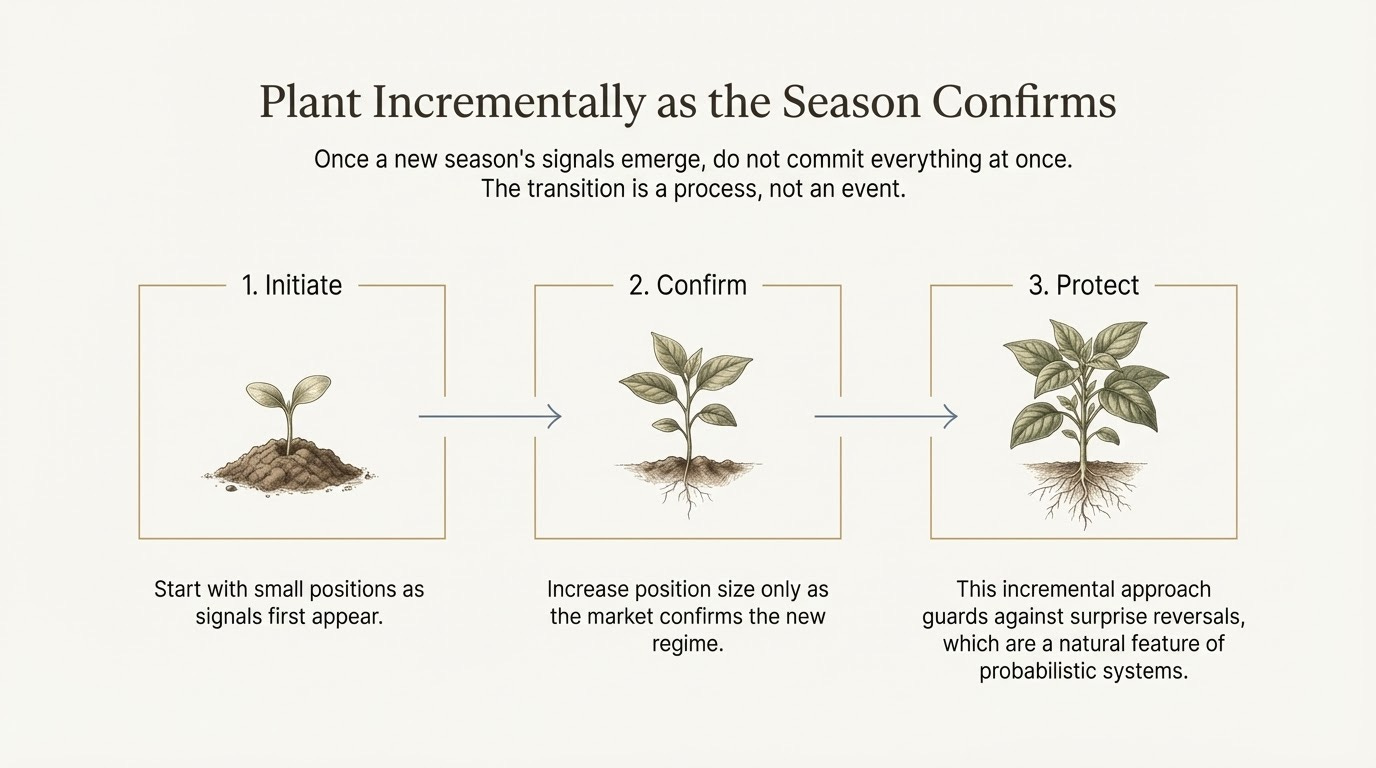

Plant Incrementally as the Season Confirms

Timing determines returns more than selection. This follows directly from how compounding works in bounded time windows. A seed planted at the season’s start accumulates growth for the entire season. One planted halfway through loses half the growth window. If a tomato plant has 120 days to grow and you plant on day 60, half the potential harvest is surrendered regardless of perfect seed selection or soil composition.

This creates an asymmetric payoff structure: plant too early and a surprise freeze kills the whole crop (left tail risk). Plant at optimal time for maximum harvest potential. Plant too late and you’ve reduced risk but sacrificed total growth.

The rational strategy is to plant when conditions are good enough, not perfect. By the time consensus forms that conditions are perfect, you’ve traded certainty for harvest as competition for resources intensifies. A better approach is to act near 80% certainty. When tree sap flows, flower bulbs emerge, and buds swell, it’s time to get the first seeds in the ground.

As emerging transition signals near 80% confidence, plant incrementally. Begin with a few seeds to hedge against an early freeze. Once the season transition is confirmed, these seedlings can be nourished into large positions. This maximizes time in the ground, optimizing for the maximum growth allowed in specific circumstances.

The investor should enter positions concurrently as the regime transition is being confirmed, not after it’s priced in by consensus. Those who only buy growth stocks at the consensus peak of a growth regime will always perform average to poorly. Those who buy too much too early, anticipating a regime that fails to arrive, suffer catastrophic losses.

Observe Every Response Then Nurture Vigor, Starve Weakness

With seeds in the ground comes the most difficult step: observe, be patient, and see what grows.

Investment outcomes follow a power law distribution. Most positions produce underwhelming or negative returns, a small percentage generate good returns, and a tiny percentage produce exceptional returns that dominate total portfolio gains. This isn’t a methodological flaw, it’s the structural reality of probabilistic, dynamic systems.

When assets that historically outperform in the current season begin rising with momentum and breadth, showing biological vigor, the market is confirming the statistical patterns of the past. This is your signal to increase position size. Press winners aggressively. The market’s complex computational system is validating your thesis.

This is the Matthew effect in action: “For to everyone who has, more will be given, and he will have an abundance.” Accumulated advantage accrues to those who have, rather than those who have not. Let your winners run, allowing compounding to work its mathematical magic.’

When assets that historically outperformed fail to grow or behave sickly, the market is providing information. Something about this specific instance contradicts history. When this happens, don’t argue with the market.

The gardener must accept when the right seed in the right season, for unknowable reasons, isn’t going to take root. Similarly, the investor must aggressively sell an underperforming asset and reallocate to a different historical outperformer. Cut losers quickly, always protecting capital.

The mathematics here is unforgiving. A 50% loss requires a 100% gain just to break even. A 90% loss demands a 900% gain to recover. This asymmetry means protecting against the left tail matters far more than capturing every upside opportunity. As Charlie Munger said: “The only thing I want to know is where I’m going to die so I never go there.”

Recycle capital from losers into different assets with signal confirmation. Kill ruthlessly that which is sick. The goal isn’t to produce prize winning pumpkins, it’s to avoid catastrophic financial losses.

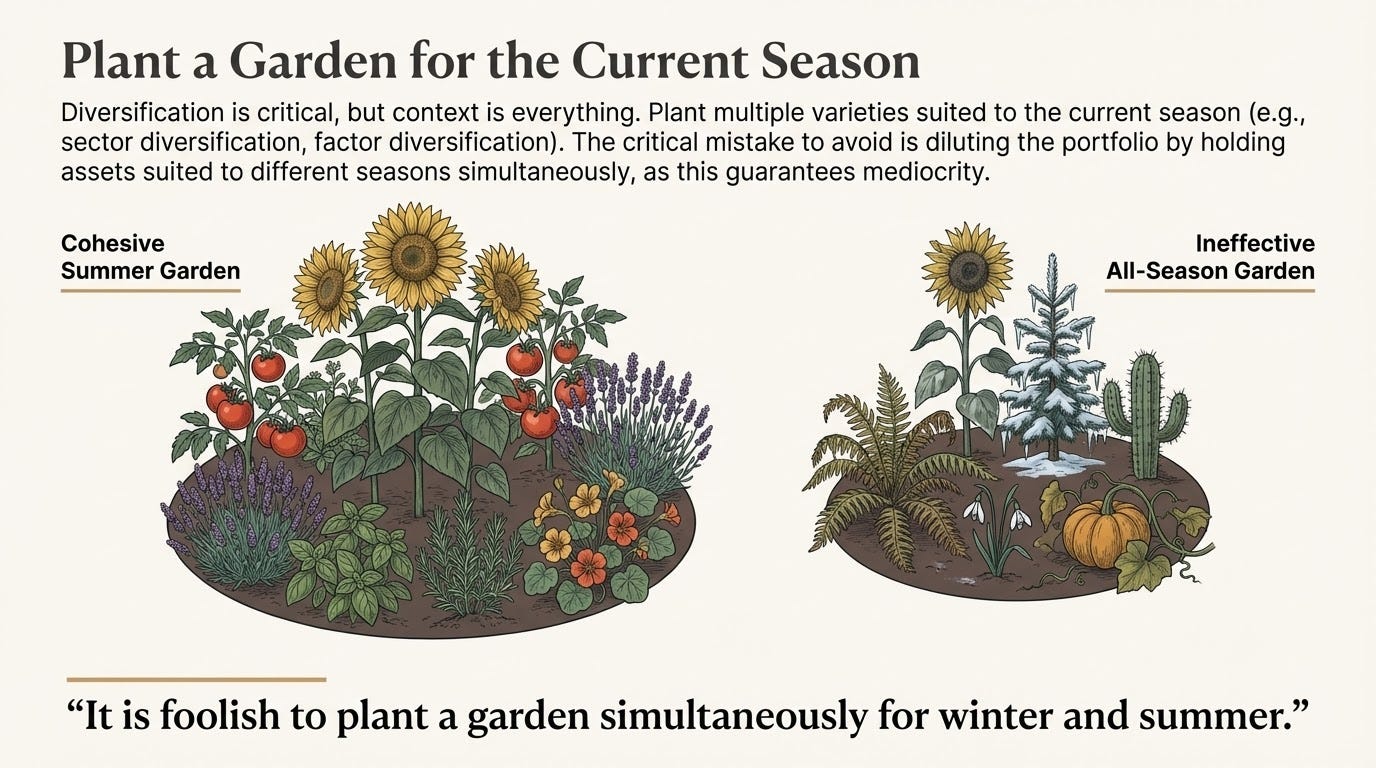

Diversify Within Seasons

Even with perfect execution and best practices, some assets that usually thrive will inexplicably fail. Gardens don’t behave like the non-interacting models of classical economics. In real gardens and real markets, probability matters more than prediction.

Like the hidden hydrodynamics of garden soil, markets are networks of agents whose collective behavior produces emergent, nonlinear outputs. These agents observe each other’s actions, follow trends, trigger stop-losses, face margin calls, and create cascading feedback loops. Assets move in fat tailed distributions where statistically impossible events occur once a decade.

This means some seeds that usually fail will thrive. The practitioner cannot know which specific ones will succeed, only play the most favorable odds across many attempts. Plant a variety of seeds in each season to nourish what grows and prune what fails.

For investors, examine historical financial data across decades over many market cycles. Identify which assets statistically outperformed in similar environments. This provides an empirical topology map that helps select assets most likely to outperform. These base rates aren’t guarantees, but planting what worked in the past while avoiding what didn’t provides a durable, repeatable edge. Critically, this methodology helps investors rigorously avoid regions where they might get killed.

If you redeploy failed capital into another historical outperformer uncorrelated with current portfolio positioning, you orient toward both concentration (betting only on winners) and diversification (uncorrelated positions). The strategy paradoxically delivers both benefits while taking advantage of the power law distribution of outcomes through repeated, high probability bets each season.

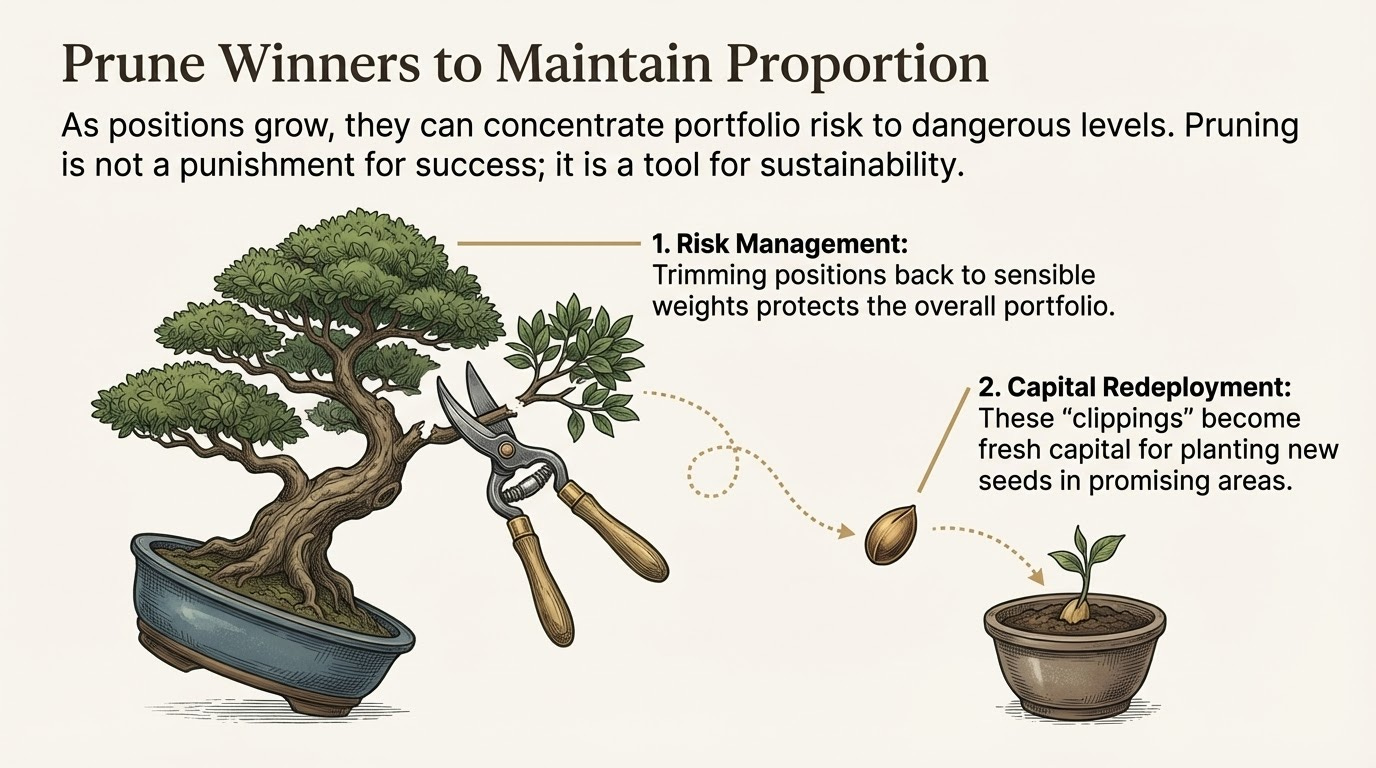

Prune Winners

The gardener cannot allow one plant to dominate the entire garden. What begins as vigorous growth eventually becomes overgrowth consuming resources, blocking light from neighbors, and creating systemic fragility. The healthiest gardens require pruning winners, not just removing failures.

Similarly, when a position grows to dominate portfolio allocation, it creates dangerous concentration risk. A single asset’s reversal can destroy accumulated gains across the entire portfolio. Trim what grows disproportionately. This isn’t abandoning conviction, it’s maintaining the conditions for sustainable, long-term growth.

Systematic trimming serves two purposes: it locks in gains from successful positions and provides capital to deploy into emerging opportunities within the current season. The capital freed from pruning winners can be reallocated to other historically favorable assets showing early signs of vigor, maintaining diversification while remaining aligned with the prevailing regime.

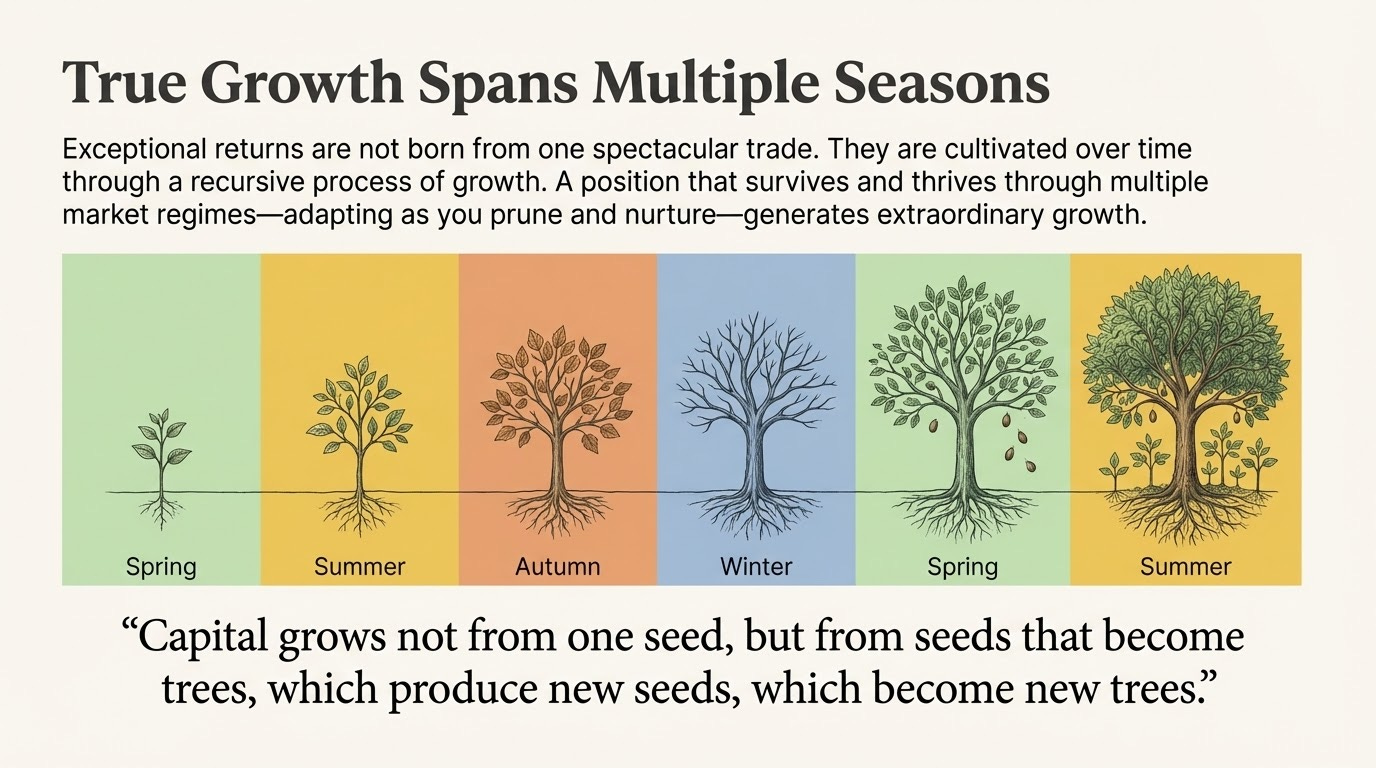

Compound Across Seasons

Seasons don’t last forever. Just as winter inevitably follows autumn, market regimes transition. The investor who remains rigid, continuing to plant summer crops as autumn approaches, faces systematic destruction. Capital preservation across seasonal transitions is how wealth compounds over decades.

When signals emerge that a season is ending, when historically reliable performers begin to falter broadly, when correlation structures shift, when volatility patterns change, the disciplined investor begins rotation. This doesn’t mean exiting all positions immediately. Like the gradual approach to planting, the transition between seasons requires incremental adjustment.

Reduce exposure to assets that thrived in the ending season. Begin exploratory positions in assets that historically perform in the emerging regime. As confidence in the new season grows, complete the rotation. This methodical approach allows you to capture late season gains while positioning for early-season growth in the next cycle.

The power of compounding emerges not from one exceptional season, but from preserving capital through multiple seasons. A modest return sustained across five regimes dramatically outperforms a spectacular return in one regime followed by catastrophic loss in the next. Size positions according to signal strength and volatility. Time entry to capture regime transitions early. Exit what fails to grow as conditions change.

The Art of Cultivating Returns

Both gardening and investing demand accepting a profound constraint: you cannot control outcomes, only tilt probabilities.

The gardener cannot command a seed to grow. They can only plant what historically thrives in current conditions, time planting to maximize growth windows, provide water and nutrients, prune overgrowth, and remove what dies. The seed’s growth emerges from interaction between its genetics, soil nutrients, water availability, solar energy, temperature, and countless microorganisms in the rhizosphere. The system is complex, adaptive, and only partially observable.

Similarly, the investor cannot command an asset to grow. They can only buy what historically performs in current regimes, time entry to capture regime transitions, size positions according to signal strength, trim disproportionate growth, and exit failures.

Some seeds will fail despite perfect conditions. Some investments will falter despite rigorous analysis. This isn’t failure, it’s the nature of complex systems. Accept the failed seedling. Accept the underperforming position. What matters is the systematic process of protecting capital, capturing favorable odds, and maintaining the capacity to plant again next season.

The gardener who cannot accept destruction becomes paralyzed, unable to prune the dead or plant anew. The investor who cannot accept losses compounds them, throwing good money after bad in denial of market reality. Wisdom lies in acknowledging what you cannot control while diligently managing what you can.

In the end, both practices teach the same lesson: work with the system’s constraints, respect its complexity, and cultivate patience. Returns, like harvests, emerge not from force of will but from alignment with forces greater than ourselves.