The Mechanics of Complex Adaptive Systems

How Autonomous Interactions Give Rise to System Wide Behaviors From Chaos to Order

Early scientists tried to model the world like a big machine of cause and effect interactions. They believed that with enough computational horsepower and the right equations, anything could be modeled accurately. They thought that by continually digging for more data and computational strength, they would inevitably uncover valuable discoveries.

However, they soon realized that some systems defy this approach, as understanding local cause-and-effect interactions alone was insufficient to fully explain system-wide behavior.

Small changes in initial conditions could lead to vastly different outcomes, revealing that the relationships were not linear but super-linear.

Moreover, instead of independent variables driving dependent ones, it became apparent that some systems were interconnected with only dependent variables.

Enter chaos theory and complex adaptive systems.

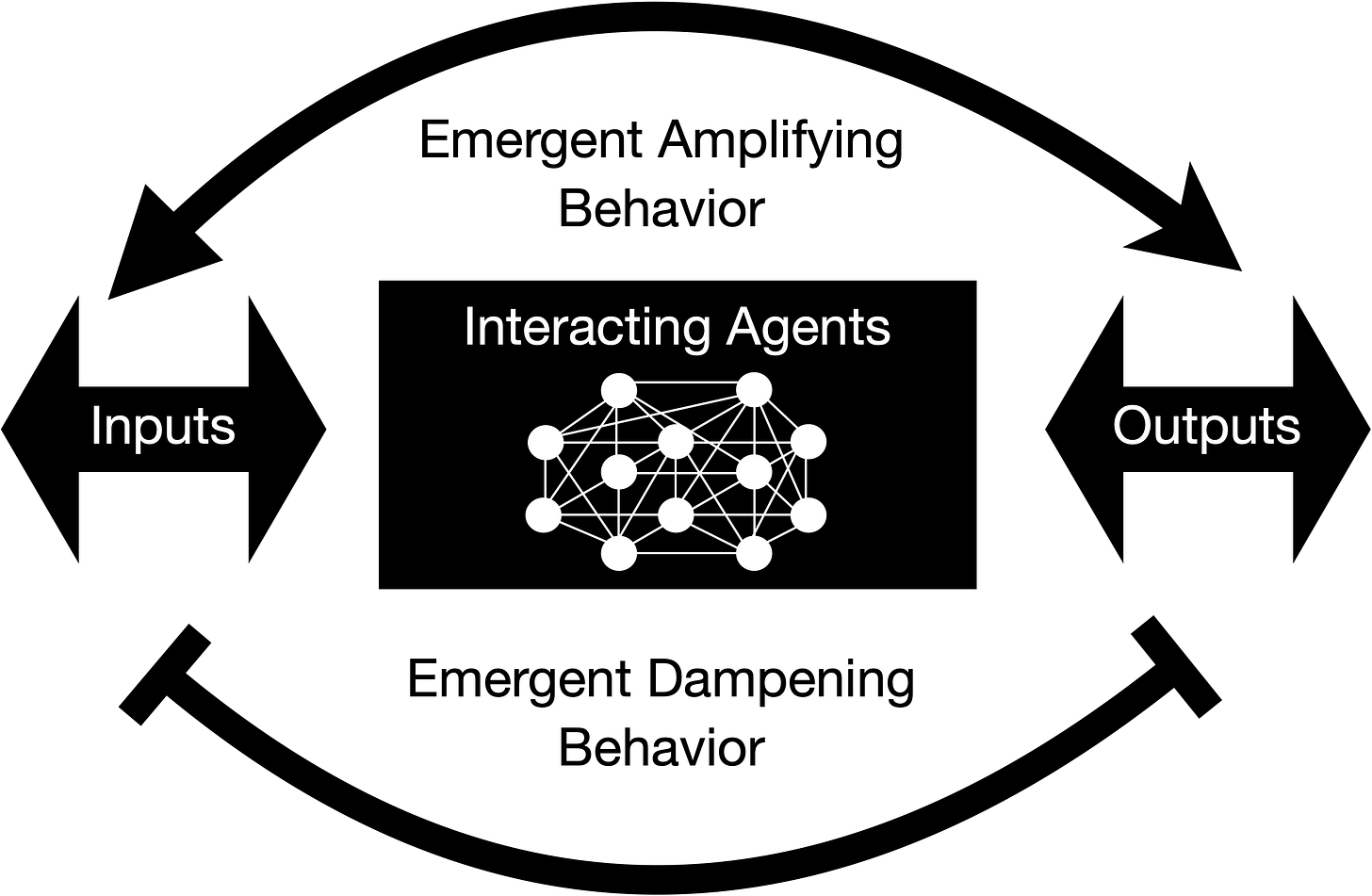

A complex adaptive system (CAS) is a dynamic network of diverse, autonomous agents that interact, self-organize, and adapt their behavior in response to a constantly changing environment. Over time, the repeated interactions among agents lead to system-wide behaviors that cannot be fully understood by examining individual interactions alone. Due to the dynamic and nonlinear nature of these interactions, the system produces emergent outcomes that are greater than the sum of its parts.

The agents within a CAS lack awareness of the broader system they are part of, making it impossible to fully explain emergent phenomena by studying local interactions alone. The complex, super-linear relationships between agents, initial conditions, outputs, and feedback loops obscure cause and effect, rendering CAS effectively a "black box."

Biology offers many great examples of complex adaptivity because nature uses this organizational structure to solve highly complex coordination problems.

Consider the emergent behavior of a beehive.

Without any single bee in control, a beehive effectively adapts to the changing needs of the brood, fluctuating food availability, and internal temperature. The hive coordinates foraging patterns, swarming behavior, wing fanning for air circulation, and adjusts worker and drone reproduction rates to respond to a constantly shifting environment.

Or consider the beautifully synchronized and emergent murmuration behavior of a flock of birds.

Ant colonies solve complex coordination problems without any leadership, relying only on simple rules and chemical signals.

Complex adaptive systems are all around us. They are the structure of the economy and financial markets, of societies, of families, of the climate, of supply chains, of the immune system and even the neuroplastic network of the human brain. They all share the same features of heterogenous agents who interact leading to emergent system wide phenomena.

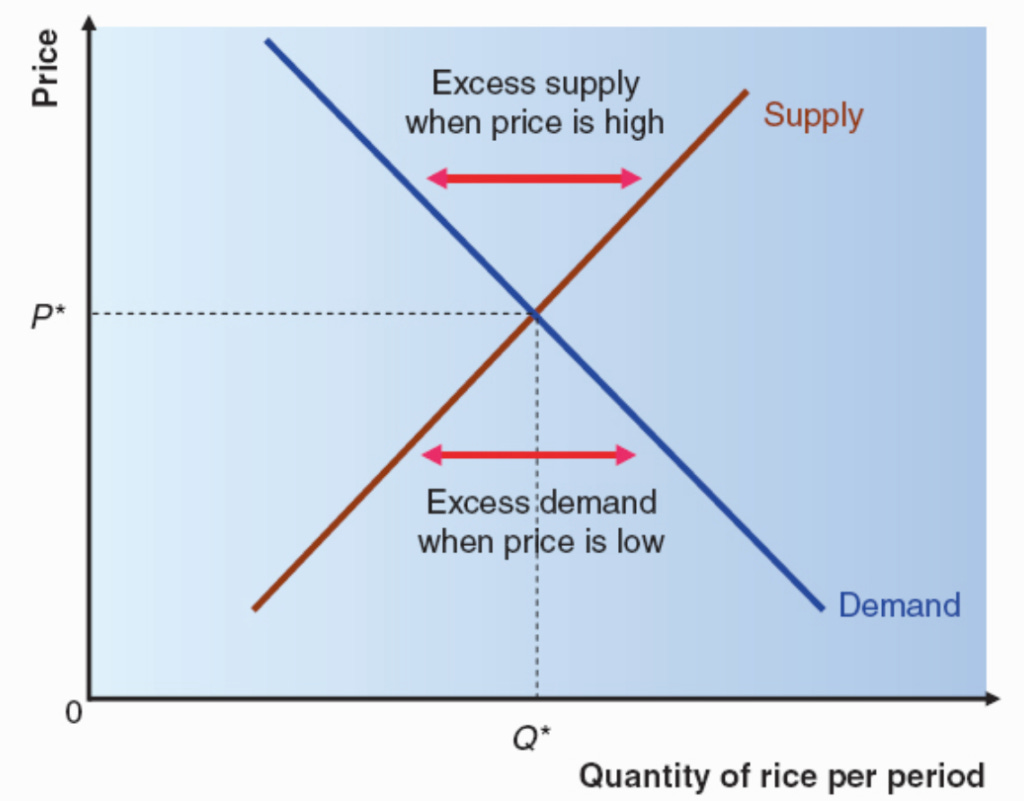

Complex adaptivity is the reason why legendary investor George Soros thought the idea of market equilibrium was bullshit. In his book the “Alchemy of Finance,” he instead calls the phenomenon “reflexivity. “

Reflexivity occurs because the views and expectations of market participants influence market events, and in turn, these events shape participants' perceptions. The participants are thinking agents with imperfect information who interpret facts through their personal biases, interacting and self-organizing often with flawed models of the world.

This led Soros to reject the traditional economic model of market equilibrium.

Instead of having independent and dependent variables, markets are entirely composed of dependent variables, preventing markets from ever settling into an equilibrium.

Soros argues emergent phenomena like bubbles and crashes arise because actions like bidding up or selling down a stock continually alter perceptions of that stock’s value. As a result, markets are always on a pendulum swing away from equilibrium rather then towards it. If market equilibrium exists it is a pushing force rather than pulling force.

The lens of complex adaptivity doesn’t fit neatly into cause-and-effect mathematical models, but it is often the most accurate perspective to use. Soros believed that using a faulty model is more dangerous than using no model at all.

A related concept is the observer effect, which is prevalent across various fields. In social sciences, it’s known that people change their behavior when they know they are being observed. This effect is also embedded in the fundamental architecture of the universe, where a photon changes its behavior from a wave to a particle when observed.

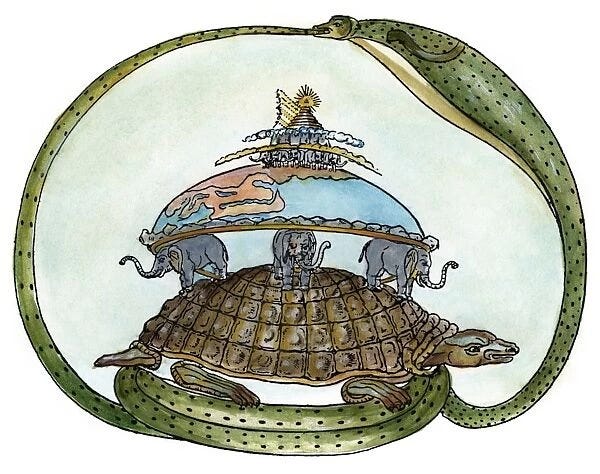

The Egyptians provided one of the earliest symbolic representations of complex adaptive systems with the ancient symbol of Ouroboros, a snake endlessly eating its own tail.

Hieroglyphs of Ouroboros near the sarcophagus of the Egyptian pharaoh Tutankhamun, 1300s BC.

Once you understand the structure of complex adaptivity, you quickly realize that we are deeply embedded within and are born into these systems. Like nested Russian dolls, these systems often exist within one another.

“Systems gardener” Alex Komoroske says “everything in life is a game within a game within a game, endlessly layered.”

To play well, the first step is recognizing you’re embedded inside a game.

The second step is discerning the rules and structure. In my experience, people confuse rules with the pressure of social structures. There are less rules than you think.

After awakening and discernment, the last and most freeing step is discovering that what feels like a death after a botched play in one game merely transitions you into another game because life is iterative.

Instead of turtles, it's complex adaptivity all the way down.

Drawing from an ancient Hindu ceramic depicting the tortoise Akupara supporting the elephants that hold the Earth, all surrounded by the self-devouring serpent, Asootee.